Do credit scores really matter? For most of us, the answer is a big, fat YES. And your credit score isn’t just a matter of paying your bills on time—here’s what a credit score means, why credit scores matter and the surprisingly easiest ways to increase your credit score.

What is credit?

Buying on “credit” is a contractual agreement in which you (the borrower) receive something now and agree to repay the lender later, generally plus interest. Put another way, credit is debt. This is why those plastic cards in your wallet are called credit cards: you swipe now and must pay that amount at a later payment date (plus interest if you miss the established payment date).

What is a credit score?

A credit score is a three-digit number that quantifies your creditworthiness. In other words, the number represents your financial trustworthiness and the likelihood that you pay back your loans on time. Bigger is better in this scenario—the higher your credit score, the more likely you are to qualify for a loan, higher credit limits and beneficial interest rates.

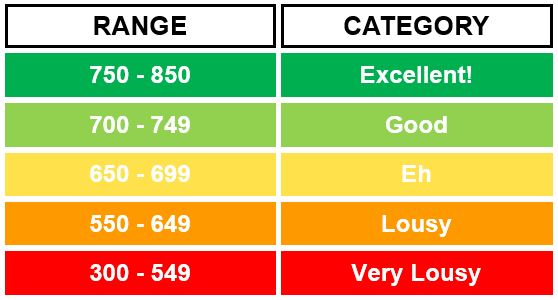

Credit scores typically range from 300 to 850, as follows:

Note: Lenders have their own definitions of what is a good credit score, so the categories above are only guidelines.

Note: Lenders have their own definitions of what is a good credit score, so the categories above are only guidelines.

To give you some perspective, Experian has generally found the average credit score in the U.S. to be between 675 and 700 over the past few years.

When do credit scores matter?

Credit scores cast a wider net on our lives than you might expect. The most obvious impact credit scores have on our lives is when we buy something on credit. When we apply for a loan to purchase something, such as a mortgage, car loan or even credit card, our credit scores have a direct impact on (1) whether we qualify for the loan, (2) the amount we can borrow and (3) the interest rate we pay on the debt.

For instance, say you found your dream home that costs a cool $500,000. You’ve saved enough for a 20% down payment of $100,000, but you need to borrow the remaining $400,000 via a mortgage.

- Under scenario 1, you have a credit score of 600 (ouch). Based on this score, the bank offers you a 30-year mortgage with an annual percentage rate (APR; i.e., interest rate) of 6%. Over the course of these 30 years, you will make monthly payments of almost $2,400 for a total mortgage cost of over $860,000.

- Under scenario 2, you have a credit score of 750 (nice job!). Based on this score, the bank offers you a 30-year mortgage with an APR of 4%. Now you make monthly payments of approximately $1,900 for a total mortgage cost of less than $690,000.

In this particular example, a credit score difference of 150 points resulted in higher payments of approximately $500 per month and more than $170,000 over the life of the loan! As Donald Trump would say, this is YUGE!! Potentially worse, if we’re being honest, there’s a high likelihood that the bank in scenario 1 would deny your mortgage application in the first place.

As you hopefully can see in this example, the more debt you have, the more you should care about your credit score. However, credit scores also come into play in other areas of our daily lives. Here are just a few of the other ways that your credit score can impact you:

- Insurance: Most insurers use your credit score as a factor to determine your premiums.

- Employment: Many employers use credit checks of your credit history (but not your credit score) as part of their hiring process.

- Rentals: Landlords reference your credit score when deciding whether to lease you an apartment and charge you up-front deposits.

- Phone plan: The types of plans offered to you by phone providers depend on your credit score.

- Utilities: Your credit score can impact your cost and/or availability of utilities (e.g., water, gas, electricity).

How is my score calculated?

Your credit score is not solely based on your ability to pay debts on time. In fact, there are many financially responsible people who have never once missed a debt payment that have poor credit scores. How could this be? There are other factors to your credit score, and knowing these factors gives you the opportunity to improve your score over time. Let’s get to it.

Your credit score is calculated based on the following five factors, each with a different weighting (click on each toggle for further information):

Comprising a whopping 35% of your credit score, your payment history affects your credit score more than any other factor. Any issues you’ve had in paying your bills on time, such as missed payments, collections, bankruptcy, repossession or tax liens, can put a big dent in your credit score. Even one missed payment can hurt your score, although you generally have a 30-day buffer before lenders notify credit bureaus. In summary, pay your bills on time each month!

The second-most-important ingredient to your credit score is your amount of debt. In addition to the overall debt you owe, lenders focus on your credit utilization ratio. What the heck is that? This ratio is a calculation of your current credit used divided by your total credit available.

To illustrate, if you have two credit cards with credit limits of $10,000 each (total of $20,000) and have outstanding purchases on those cards of $4,000, your credit utilization ratio is 20 percent (4,000 / 20,000).

You want to keep your credit utilization ratio LOW. Why? A low credit utilization ratio indicates that you have the discipline to not use all of your available credit and are thus lower risk. As a rule of thumb, you should strive to keep your credit utilization ratio less than 30 percent. In other words, you should strive to only charge 30 percent of any credit card’s available limit. To do so, you can either reduce your purchases on credit or increase your available credit.

Unless we’re talking about criminal activity or eating tide pods, experience is typically a good thing. So too is the case with credit history, as lenders place a 15% credit score weighting on the age of your oldest account and average age of all your accounts. Having an “older” credit age is better for your credit score as it shows lenders that you have experience managing your debt. To help yourself in this category, do not close your oldest account. In addition, opening new accounts (e.g., credit cards or other loans) will lower the average age of all your accounts, so be mindful of this fact before opening several new accounts.

Applying for new credit can shave several points off your credit score. In fact, lenders monitor both your recently opened accounts as well as your credit “inquiries.” Every time you submit an application that requires a credit check (i.e., the lender requests your credit report as part of their decision-making process), a “hard inquiry” is recorded to your credit report. These hard inquiries, which remain in your credit file for up to two years, comprise 10 percent of your credit score. Other inquiries known as “soft” inquiries—those resulting from you checking your own credit report—do not impact your credit score. Avoid submitting several credit applications, especially within a short period of time, to protect your credit score.

The credit industry loves diversification. In fact, people with exceptional credit scores (800+) typically manage a diverse portfolio of credit, such as credit cards, car loans, mortgages, student loans, personal loans and other revolving accounts or installment loans. This is not to say that you should go apply for all sorts of debt! Rather, a diverse mix of accounts, assuming that those accounts are paid in full, indicates that you have strong experience managing different types of credit at the same time. Because credit mix constitutes 10 percent of your credit score, consider branching out on your types of credit to receive a score bump.

The five factors above constitute 100 percent of your credit score. Anything else—such as your age, income, employment status, friends on social media or number of abs—do not impact your credit score, at least directly. Also, keep in mind the weightings listed above. Two factors—payment history and debt utilization—comprise 65 percent of your credit score. Thus, it’s much more important to focus on these areas than, say, taking out a personal loan to increase your mix of credit.

For more specific advice, refer to our post on the 6 Ways to Increase Your Credit Score.

Where can I find my credit score?

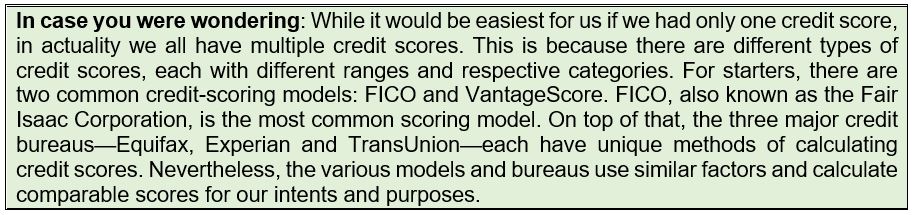

There are three main credit bureaus that monitor your credit: Equifax, Experian and TransUnion. Each bureau uses their own scoring model and algorithm to calculate credit scores, so you will have a unique credit score and credit report from each credit bureau. When you submit an application requiring a credit check, the decision-maker will typically submit a request for your credit check from one of the three bureaus.

In a similar regard, you too can access your credit report or credit score from the three bureaus (and you should!). Your options for accessing your credit report are different from those for accessing your credit score, as follows:

- Accessing your credit report

A credit report is a summary of your past and current credit accounts based on financial information reported by your lenders and creditors. Your credit report will typically contain your personal information, credit accounts, hard inquiries (i.e., credit applications), bankruptcies and past-due accounts, including accounts turned over to a collection agency. Notably absent from your credit report, however, is your credit score.

Accessing your credit report is simple as you have one tried and true option: AnnualCreditReport.com. Using this website, you have access to free credit reports from each of the three credit reporting agencies on an annual basis. You’re also entitled by law to your credit report if you’re unemployed, on welfare or within 60 days anytime you’re denied credit.

- Accessing your credit score

Finding your credit score—at least a free credit score—isn’t quite as straightforward. Credit bureaus will typically charge you a small fee to access your score, and the free credit reports provided by AnnualCreditReport.com or other credit reporting agencies do not currently include free credit scores. However, if you’re craving a free glance at your current credit score, you do have some options:

- Credit cards: Several credit card companies—American Express, Bank of America, Barclays, Chase (Slate card), Citibank, U.S. Bank and Wells Fargo, among others—offer your credit score for free via your online account or monthly statements. Check with your credit card company regarding whether and how you can access your score.

- Discover Credit Scorecard: You can access your credit score via Discover Credit Scorecard, a free option whether you are a Discover customer or not.

- Creditors: If your creditor pulls your score and denies your application or offers you unfavorable interest rates compared to other consumers, the creditor is generally required to disclose your credit score.

- Credit unions: Some credit unions provide your credit score for free, so it’s worth asking.

- Other options: Certain websites, including Credit Karma, Credit.com, Bankrate, FreeCreditScore and Credit Sesame, allow you to access your free credit score if you create a profile. With these websites, be careful not to unintentionally enroll in a program that charges separate fees.

What if I don't have a credit score?

According to a 2015 report by the Consumer Financial Protection Bureau, more than 50 million people don’t have a credit score. This is especially common for young adults who do not yet have any credit history or only very recently established credit (note that you typically need to have an account open for six months before you receive a credit score). You may also have no credit score if you have not used your credit accounts in several months.

If you fall into this category, do not worry: you now have the knowledge to start on the right foot. Getting approved for your first credit account can be challenging considering most creditors and lenders reference your credit score before approving your application. However, here are some potential options to help get you started:

- Apply for a secured credit card: Requires a security deposit to secure your credit limit.

- Become an authorized user: Ask a friend or relative if you can be added as an authorized user on their account. This requires the trust of the main cardholder as you will generally be given the same spending privileges on the account. Credit card issuers typically report authorized users to credit bureaus, so you can attain some credit history.

- Apply for a joint credit card: If you trust a friend or relative, ask if they’ll apply with you for a joint credit card. You both would be equally responsible for paying off the balance.

- Apply for a credit card at local bank or credit union: Local banks and credit unions may be willing to approve your credit, especially if you already have a savings or checking account with the institution.

- Research credit cards available with no credit: Several credit card issuers offer credit cards to applicants with no credit score. If you are a student, also check whether a student credit card is available. However, read the fine print for any card before applying as some cards charge extremely high interest rates.

Once you’ve had the account open for six months, you should have a credit score and have the option to apply for new credit previously unavailable to you.

Super helpful, especially the percentages impacting credit scores

Thanks again, Caitlin!

I wonder how many people actually know the credit components…

Good question. My guess is a pretty low percentage

Another one to pass along 🙂

Thanks again!

Great!

Glad you like it, Leon. Feel free to subscribe

Straightforward and to the point. I like this.

Thanks Brad

Good to know the reason I’ve struggled to find my credit score

I wish it were easier too

“Very Lousy”…lol

Not exactly the way credit bureaus define their range, but I prefer it 🙂