When you’re first introduced to the working world, a 401(k) might sound like an unnecessarily long foot race or advanced type of airplane. Au contraire, these 3 numbers and letter could be your single most important shortcut to retirement. This post covers everything you need to know about the most common employer-sponsored retirement plan.

401(k) Basics

A 401(k) is a retirement savings plan sponsored by an employer and generally offered to employees of public or private for-profit companies. As discussed in the previous post on employer sponsored retirement plans, estimates indicate about 80% of all U.S. employees have access to any company-sponsored retirement plan, and 401(k)s only represent a portion of the accounts available for that lucky bunch. However, if you’re one of the lucky ones to have access to a 401(k), make sure you take advantage of it!

So what makes a 401(k) so special? Two things—(1) tax savings and (2) potential employer match.

To start, a 401(k) offers tax incentives for your retirement savings. That is, you can defer paying federal and state income taxes on your retirement account savings and their investment earnings until you withdraw the money at retirement (traditional) OR you can pay federal and state income taxes up front and allow your savings and their earnings to grow tax-free, without paying taxes when you withdraw the funds at retirement (Roth). Do not underestimate the power of taxes—even 15% on such a large retirement balance is hefty, so remember that a 401(k) offers you CONSIDERABLE tax savings. We’ll discuss traditional vs Roth in more detail below.

Next, like puppies and carnival rides, an employer match is just plain wonderful. While all 401(k) plans provide tax savings, 401(k) match percentages vary by employer. In fact, by law, employers are not required to match any part of an employee’s investment in a 401(k) plan. However, fortunately for those of you with 401(k)s, employer matches are the norm and not the exception. Most 401(k) plans provide employer contributions, and these contributions usually range from 1% to 6% (or even more) of employee contributions. The most common 401(k) employer match is 3%, often denoted as 50% of employee contributions on the first 6% of salary the employee contributes. Regardless of the match percentage, if you’re lucky enough to have an employer offering a 401(k) with any match, make sure you take advantage of it.

When you invest in a 401(k), you control how you invest the money. The value of your account is based on the contributions made (by you and your employer) and the investments’ performance over time. Compared to the other employer-sponsored retirement plans, 401(k)s generally offer the most comprehensive list of investment options, including mutual funds, exchange-traded funds (ETFs), annuity contracts and individual securities.

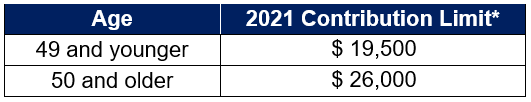

Although a 401(k) is a fantastic savings vehicle, it has restrictions. To prevent you from tapping your retirement account savings before retirement, the IRS imposes costly penalties for withdrawing your funds prior to retirement (with the exception of certain circumstances, which we will discuss further below). In addition, each year, the IRS sets contribution limits for your retirement accounts. The IRS contribution limits for a 401(k) in 2021 are as follows:

*Your total contribution, including your contribution and your employer’s contribution/match, cannot exceed $58,000 or 100% of your salary ($64,500 or 100% of your salary if age 50 or older)

As shown in the chart above, employees can contribute up to $19,500 to a 401(k) account out of salary in 2021. Employees age 50 and over can make extra contributions of up to $6,500, bringing the total annual limit to $26,000 for those age 50 and older. Note that the $19,500 and $26,000 limits do NOT include the employer match contributions, but your total contribution (including your employee contribution and your employer’s match) cannot exceed $58,000 or 100% of your salary in 2021 ($64,500 or 100% of your salary if age 50 or older).

Before we get to the investment options that are best for you and how much you should contribute, let’s first take a look at understanding which account you should select—traditional or Roth.

Traditional vs Roth

If your company offers a 401(k), chances are it offers a traditional account; however, certain companies also offer a Roth account, which is less common. The difference between “traditional” and “Roth” plans is purely a difference in timing of when you pay state and federal income taxes (in addition to certain limitations on withdrawals). When you designate which percentage of your paycheck you want to contribute to your retirement account, your employer will deduct that amount from your paycheck to deposit into your retirement account. Whether or not those funds are taxed prior to deposit into your account or afterwards, when you eventually withdraw the funds from your retirement account, depends on whether your account is traditional or Roth.

Let’s take a look at the specific characteristics of traditional and Roth 401(k)s:

Traditional 401(k):

- Taxes Deferred: For a traditional 401(k), your employer deposits your contribution directly into your retirement account tax-free. In other words, your employer withholds no taxes on this income to pay taxes on your behalf, and eventually when you file your taxes, this contribution amount will be deducted from your total taxable income.

- Taxes upon Withdrawal: Once deposited into your retirement account, your investments and their earnings (reinvested) grow tax-free until withdrawal. While you haven’t yet paid taxes on these amounts, having pre-tax investments early allows the larger amounts to compound over a long period of time. Upon withdrawal of funds from your account, you pay income taxes on both your contributions and earnings.

- No Access before 59 ½: For all contributions and earnings in a traditional 401(k) account, you cannot access the funds before age 59 ½ without paying taxes and a penalty (except for certain circumstances discussed below). If you withdraw funds from your account prior to this date, you will pay the applicable income taxes on the full amount withdrawn as well as a 10% penalty.

- Mandatory Withdrawals at 72: Upon reaching age 72 (age 70 ½ if born prior to July 1, 1949), the IRS requires you to withdraw at least a minimum amount each year from your account and pay ordinary income taxes on the withdrawal (the government wants some money!). If you don’t take withdrawals, or you take less than required, you’ll owe a 50% penalty tax on the difference between the amount you withdrew and the amount you should have withdrawn (yikes: go remind Grandpa!).

Roth 401(k):

- After-Tax Contributions: For a Roth retirement account, your employer withholds ordinary income taxes on your contribution before depositing the after-tax amount into your account. Therefore, when you file your taxes for the year, the amount contributed to your retirement account will remain in your total taxable income.

- Tax-Free upon Withdrawal: Once deposited into your retirement account, your investments and their earnings (reinvested) grow tax-free. You then pay no, zilch, nada taxes on the contributions and their earnings upon withdrawal (what a deal!).

- Flexible Access before 59 ½: In order for a withdrawal from a Roth retirement account to be qualified (i.e., tax- and penalty-free), you must (1) have been contributing to the account for the previous 5 years and (2) be at least 59 ½ years old. However, if you must make an unqualified withdrawal from your Roth 401(k) (not recommended!), such as when you make a withdrawal before the 5-year period and/or you have not yet reached the age of 59 ½, you only have to pay taxes and a penalty on the portion of the withdrawal that represents earnings (except for certain circumstances discussed below). But this does not mean you can make an early withdrawal and designate the total amount as contributions as opposed to earnings. The IRS treats each withdrawal on a pro-rata basis, allocating taxes and penalties to each withdrawal based on the total percentage of earnings in the 401(k) account.

To illustrate, say you have $100,000 in your Roth 401(k), of which $90,000 is from contributions and $10,000 is from earnings on those contributions. Any withdrawals will be considered to come 90% from contributions and 10% from earnings, meaning 90% would be nontaxable and the other 10% would be taxable and possibly subject to a 10% penalty. To illustrate further, assume you’re 45 years old, you’ve been contributing to your 401(k) for at least 5 years, and you make a withdrawal of $20,000 from your Roth 401(k). Of the distribution, $18,000 (20,000 x 90%) would be nontaxable and $2,000 would be taxable and potentially subject to a 10% penalty. If your tax rate is 24%, you would pay approximately $680 in taxes and fees to make this early withdrawal. However, these taxes and fees would be significantly lower than those required for early withdrawal on a Traditional 401(k).

Note if you have a diversified (traditional and Roth) retirement plan account, you usually can choose the account from which you withdraw funds. This allows you to minimize your penalties/taxes depending on when you plan to make the withdrawals.

- Mandatory Withdrawals at 72: Similar to the traditional account, upon reaching age 72 (age 70 ½ if born prior to July 1, 1949), the IRS requires you to withdraw at least a minimum amount each year from your Roth account. If you don’t take withdrawals, or you take less than required, you’ll owe a 50% penalty tax on the difference between the amount you withdrew and the amount you should have withdrawn (yikes: now go remind Grandma!).

The following provides a summary of the primary traditional vs Roth 401(k) differences:

*Mandatory withdrawal age is 70 ½ if born prior to July 1, 1949 (changed by SECURE act beginning January 1, 2020).

401(k) Exclusions to Early Withdrawal Penalties

The easiest way to avoid early withdrawal payments is to not tap your retirement account before age 59 ½. Yet s**t happens, and sometimes you don’t have any other choice than to withdraw the funds early. But good news! The IRS comes to the rescue when you’re going through hardship. The IRS will not charge you the 10% penalty on non-qualified withdrawals (i.e., those traditional plan withdrawals before age 59 ½ and Roth plan withdrawals before age 59 ½ or before you’ve been contributing to the account for the previous 5 years) from your 401(k) under the following circumstances:

- Medical expenses (To pay for unreimbursed medical expenses in excess of 10% of Adjusted Gross Income (>7.5% if age 65 or older). We will cover AGI in our post on taxes)

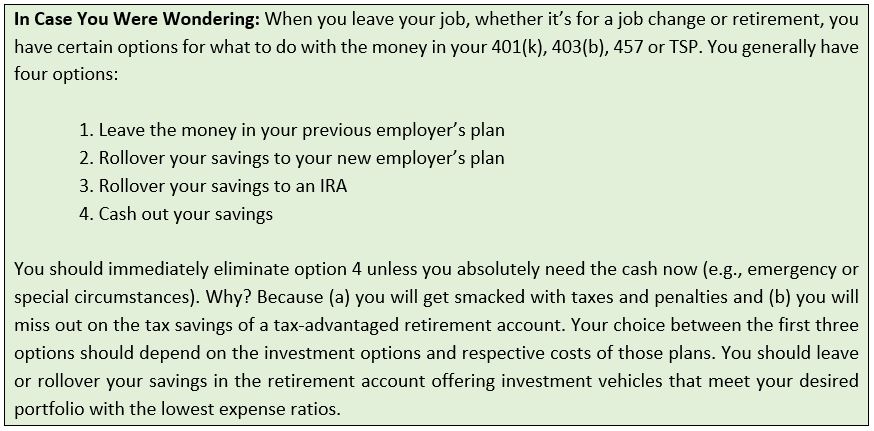

- Rollovers to an IRA or other qualified plan (To transfer balance in 401(k) account to another qualified plan)

- Separation from company (When you retire, quit or get fired from your job during or after the year you reach age 55 [age 50 for public safety employees of certain plans]; if you do this, do not roll over your plan to an IRA or other qualified plan because this rule only applies to your current plan)

- Substantially equal periodic payments (You receive substantially equal periodic payments over your life expectancy; must be separated from employer)

- Birth/adoption expenses (Up to $5,000 per parent for birth/adoption expenses if you had a baby or adopted a child in the past year)

- Military (You are a qualified military reservist called to active duty)

- IRS Levy (IRS takes money directly from your account to pay taxes owed)

- Court-ordered domestic payments (E.g., to pay spousal payments)

- Disability (Total and permanent disability of the participant or owner)

- Death (Of the participant or owner)

It’s important to distinguish between 401(k)s and IRAs for early withdrawals: the IRS provides exceptions to the early withdrawal penalties for Education (qualified higher education expenses), First-Time Homebuyers (only up to $10,000) and Medical Insurance Premiums (only if unemployed) for IRA’s only; therefore, you will be penalized for unqualified withdrawals from your 401(k) for these expenses.

Which One to Choose – Traditional or Roth?

There’s an ongoing debate and many example calculations about which is better: traditional or Roth. Most people will tell you a Roth retirement account is the better option, if available. But this is not necessarily true. Your choice should really depend on your circumstances and, specifically, how much higher (or lower) you think your tax rate will be during retirement.

Those in favor of the Roth account claim the small tax bill upfront—in exchange for what would otherwise be an undoubtedly larger tax bill later—provides more tax savings and prevents you the burden of, and uncertainty in, paying taxes at retirement. On the other hand, those in favor of the traditional account claim these plans allow you to invest more now (assuming you haven’t reached the annual limit) from pre-tax dollars which will experience compound growth and in many cases create a higher after-tax return than a Roth account. Decisively determining which plan is best for you requires a detailed calculation with many assumptions regarding your income and tax rate at retirement. I don’t know about you, but (a) I don’t have a clue what my retirement income will be and (b) I don’t really feel like paying a financial adviser to guess my future situation either.

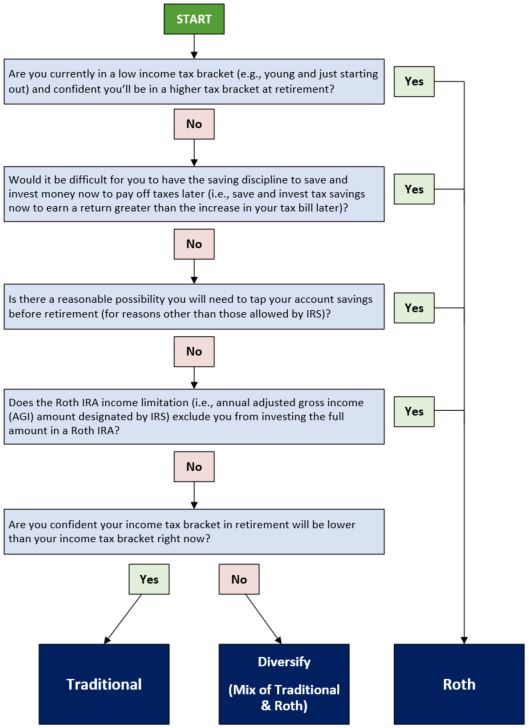

The diagram below simplifies the traditional vs Roth 401(k) decision for you (note there is a different decision tree for traditional vs Roth IRA). This decision matrix is not perfect, but it will give you a good reference point on which you can base your decision.

As shown above, if you don’t confidently know whether your income tax rate will be higher or lower in retirement than it is today, it would be wise to hedge your bets and split your contributions between a traditional and Roth 401(k). Keep in mind, however, you’ll still be capped at $19,500 (or $26,000 if you’re age 50+) for your total annual contributions (e.g., $9,750 to traditional and $9,750 to Roth).

Employer Match

Other than tax savings, the other huge benefit of a 401(k) is the potential employer match. This is free money, people! Many employers offer to match your 401(k) contributions up to a percentage of your salary as a way of encouraging you to contribute to your plan. In particular, an employer match is part of a company’s benefits package to you; so when you’re job hunting, it’s worth considering the percentage at which prospective employers match retirement account contributions.

If your employer offers a match, your first priority after establishing your immediate obligation and emergency funds should be to contribute to your 401(k) the maximum percentage of your salary at which your employer will match.

One of the biggest mistakes you can make, especially for those of you just starting your careers, is not contributing the maximum percentage of your salary at which your employer will match. What does this mean? Frequent employer match terms are as follows: the employer matches 50% of employee contributions on the first 6% of salary the employee contributes. In this situation, you would want your contribution percentage to be at least 6%.

To illustrate, assume Johnny works for a company offering the matching terms stated above (match of 50% on first 6% of salary the employee contributes). His salary is $50,000, and he has elected to contribute 10% of his salary to a traditional 401(k) plan. Each year, Johnny would contribute $5,000 (10% of his salary) to his 401(k) plan. In addition, each year, Johnny’s company would contribute $1,500 (50% x 6% x $50,000) to his 401(k) plan. The total yearly contribution made to Johnny’s 401(k) would be $6,500. Note even though Johnny contributed 10% of his salary, the company only matches 50% up to 6% of his salary.

Assume the same circumstances for Johnny except now he decides to contribute only 4% of his salary to his 401(k) plan. Johnny would contribute $2,000 (4% of his salary), and his company would contribute $1,000 (50% x 4% x $50,000). Johnny missed out on $500 in free money by not contributing another 2% of his salary! Boooo Johnny! To sum up, the minimum Johnny should contribute to his 401(k) plan is 6% of his salary.

Some companies will match dollar-for-dollar on all contributions by an employee, though this is rare. Other companies unfortunately do not match at all. It’s important for you to know (or ask) up to what percentage of your salary your employer will match as this is the minimum contribution you should make to your 401(k) each year.

Lastly, strongly consider whether you have “vested” in your employer’s retirement plan match before leaving a company. “Vesting” refers to the delay in an employee’s ownership of company benefits for a specified number of years to incentivize the employee to remain at the company. You immediately vest in your own contributions, but usually companies require a vesting period for employer contributions (i.e., the employer match). You should be able to determine the vesting period, if applicable, by reading your plan’s terms or contacting your company’s HR department.

How Much to Contribute

Clearly it’s important to contribute at least the percentage of your employer’s match, but exactly what percentage of your salary should you contribute? The answer is as much as possible, after checking off your first four priorities (immediate obligation fund, emergency fund, maximizing employer match and paying off high-interest debt).

Most experts recommend 10% of your salary as a good starting point, but even many frugal, savvy, young professionals contribute 25% to even 30% of their salaries. These percentages should not be your reference point, however; first get through your first four priorities and determine how much money remains. As all contributions must originate as deductions from your paychecks, you won’t be able to deposit this amount directly into your retirement account. Rather, you’ll need to set a contribution percentage (this requires some math and guessing on your part) for your employer to deposit the designated percentage of your paycheck directly into your 401(k) account. Note this contribution and the percentage you choose will be recurring for every paycheck (until changed), but you can change the contribution percentage as often as you would like.

Determining the right contribution percentage can involve some trial and error. Thus, you should adjust your contribution percentage as often as necessary to get a sense of the appropriate percentage for you, especially if you start with a percentage much higher than you will be able to sustain. Remember, however, to not be overly conservative on your contribution percentage: if you have extra cash sitting in your checking or savings accounts (unrelated to your immediate obligation and emergency funds), that money could be sitting in your retirement account reaping the wonderful tax and match benefits (assuming you haven’t already surpassed the contribution limit).

Whatever that amount is, once again, at the very least you should invest enough to receive the full match offered by your company. This is the freest (yes, that’s a word) money you will ever receive, so do not forget this very important advice.

Which Investment(s) Should I Choose?

As discussed in the previous post on employer sponsored retirement plans, each employer-sponsored retirement plan offers a variety of investment options, which could include mutual funds, ETFs, annuity contracts and individual securities. Depending on whether they’re available for your particular plan, target-date funds (also known as lifecycle funds) tend to be the most popular option. True to their name, target-date funds are mutual funds including a combination of stocks and bonds that gradually become more conservative as you reach your target-date of retirement. For instance, a 25-year-old in 2020 planning to retire at age 65 would invest his/her 401(k) in a 2060 target-date fund. Target-date funds generally have fairly low expense ratios and make your investing responsibilities SIMPLE as they take no effort by you to continuously update the diversification of your 401(k) portfolio. This simplifies your investing and allows you to focus your time and energy elsewhere!

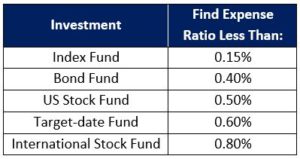

Regardless of your investment options, you should search for investments meeting your desired portfolio with the lowest expense ratios. An expense ratio is an annual fee representing the percentage of your investment that goes toward the costs of running a fund. For example, if you invest in a mutual fund with an expense ratio of 1%, you will pay $10 for every $1,000 invested each year. Over time, these fees can significantly drag down your investment returns, so it’s very important to pay attention to these ratios.

Expense ratios vary depending on the type of investment and the cost to run the respective fund. In general, you want to select investments based on the following expense ratio criteria:

Setting up your 401(k):

Most companies allow you to enroll in a 401(k) immediately upon starting your job, but some smaller employers might require you to wait up to a year. Depending on when you’re eligible, your employer should communicate a website link or instructions to access your benefits account or update your contribution percentage. If your employer doesn’t provide these instructions or information about your benefits on or soon after your start date, contact the company’s HR department to ask about retirement account plans and associated instructions available to you. Your employer usually hires an administrator, such as Fidelity Investments, to oversee your 401(k) account. Assuming this is the case, your employer will provide you a link to create an account on the administrator’s website. Once you create an account, you will be able to select your 401(k) contribution percentage as well as the mutual funds or other investments in which you will invest (e.g., target-date funds).

After finalizing your contribution percentage and investments, your employer will automatically deduct the funds from your paycheck to invest in the 401(k) on your behalf. You can monitor your 401(k) balance by logging into your account via the administrator’s website. If you have questions about your 401(k) balance/investments or want to shift money around, contact your 401(k) plan administrator.

Good luck, and happy investing! For any other 401(k)-related questions, feel free to leave a comment.

References

- https://www.irs.gov/retirement-plans/401k-resource-guide

I need this for a 403(b) please!

That’s my very next post! Hope you enjoy

Truly a one stop shop for 401(k). Great post Adam

Thanks again, Jorge!

Thank you for the info!

My pleasure. Thank you for reading!

Whew that was long. Who would have thought these plans are so complicated

This was thorough, but there’s no need to memorize this. Reference as often as you would like!

That’s hard to believe anyone outside of the 1% contributes higher than 25%. I’ll stick with my measly 5%

Haha 5% isn’t necessarily “measly.” Contribute as much as you can, but 5% is a great start. Keep in mind the maximum percentage at which your employer matches. If it’s 6%, bump your contribution up a percent

Answered all my questions, that’s for sure. Excellent again!!

Thank you again, Nancy!

I keep sending your posts to my kids and they pass along compliments!

Thank you! Keep passing along!

This is really good, Adam. A little long but still thought it was important info

Thank you!

Sending again to friends and family! They better be contributing!

Haha thanks again, Louise. Keep passing along!

Another very good article. Keep it up

Thanks again, Allysa. Appreciate the support!

Now this is what I’m talking about. Very good article with thorough detail.

Thanks, Gene. More to come!

I doubt any other site is this thorough. And so easy to follow

Thanks, Katharine. That’s what I’m going for. You’re welcome to subscribe!

You clearly favor the Roth. I’m more of a diversify guy myself

You’re right – I definitely favor the Roth. I understand the arguments for a traditional plan, but to me the benefits of the Roth are greater. With a Roth I think it’s easier to plan for retirement (because taxes won’t take a big chunk out). In addition, I have no clue what tax rates will be in 30-40 years, but I doubt they will be lower. I’ll take the risk out of it by locking in my tax rate now.

Never heard of this site but this is a great post. Nice work

Thanks, Colin. You’re welcome to subscribe

I’ve never found a decision tree for traditional vs roth. Very helpful!!

Thanks, Dominic. Glad it helped!