Have you ever heard of a 457 plan? If not, you’re not alone. Here’s what you need to get up to speed.

457 Basics

A 457(b) plan, known more commonly as a 457 plan, is an employer-sponsored retirement savings plan generally offered to employees of state and local municipal governments, including some local school and state university systems. These organizations are exempt from certain administrative processes required for 401(k) plans, allowing these employers, even those with small budgets, to help their employees save for retirement. As discussed in the previous post on employer sponsored retirement plans, estimates indicate only about 80% of all U.S. employees have access to any company-sponsored retirement plan, and 457s only represent a small portion of the accounts available for that lucky bunch. However, if you are one of the lucky ones to have access to a 457, make sure you take advantage of it!

A 457 is very similar to a 403(b): the primary differences are the types of employers sponsoring the plans, the investment choices (i.e., 457 plans generally offer more investment choices than 403(b) plans), the contribution limits (i.e., the $19,500 annual limit applies separately to both 401(k)/403(b) plans AND 457 plans) and early withdrawal penalties (i.e., 457 plans have no early-withdrawal penalties if you leave your employer). 457 plans sound pretty great, don’t they?!

So what makes a 457 so special? Two things – (1) tax savings and (2) potential employer match.

To start, a 457 offers tax incentives for your retirement savings. That is, you can defer paying federal and state income taxes on your retirement account savings and their investment earnings until you withdraw the money at retirement (traditional) OR you can pay federal and state income taxes up front and allow your savings and their earnings to grow tax-free, without paying taxes when you withdraw the funds at retirement (Roth). Do not underestimate the power of taxes—even 15% on such a large retirement balance is hefty, so remember that a 457 offers you CONSIDERABLE tax savings. We’ll discuss traditional vs Roth in more detail below.

Next, like puppies and carnival rides, an employer match is just plain wonderful. While all 457 plans provide tax savings, 457 match percentages vary by employer. In fact, by law, employers are not required to match any part of an employee’s investment in a 457 plan. However, many 457 plans provide employer contributions, and the contribution percentage is usually denoted as 50% of employee contributions on the first X% of salary the employee contributes. Regardless of the match percentage, if you’re lucky enough to have an employer offering a 457 with any match, make sure you take advantage of it.

When you invest in a 457, you control how you invest the money. The value of your account is based on the contributions made (by you and your employer) and the investments’ performance over time. While typically not matching the investment choices and costs of 401(k) plans, 457 plans generally offer a better slate of investment options, including a wider variety with lower costs, than 403(b) plans. We will detail which 457 plan investment options are best for you later in this post.

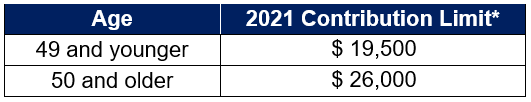

Although a 457 is a fantastic savings vehicle, it has restrictions. To prevent you from tapping your retirement account savings before retirement, the IRS imposes costly penalties for withdrawing your funds prior to leaving your employer (with the exception of certain circumstances, which we will discuss below). In addition, each year, the IRS sets contribution limits for your retirement accounts. The IRS contribution limits for a 457 in 2021 are as follows:

*Your total contribution, including your contribution and your employer’s contribution/match, cannot exceed $58,000 or 100% of your salary ($64,500 or 100% of your salary if age 50 or older)

As shown in the chart above, employees can contribute up to $19,500 to a 457 account out of salary in 2021. Employees age 50 and over can make extra contributions of $6,500, bringing the total annual limit to $26,000 for those age 50 and older. Note that the $19,500 and $26,000 limits do NOT include the employer match contributions, but your total contribution (including your employee contribution and your employer’s match) cannot exceed $58,000 or 100% of your salary in 2021 ($64,500 or 100% of your salary if age 50 or older).

However, 457 plans offer two potentially beneficial wrinkles to these contribution limits: (1) if your employer offers a 457 plan in addition to a 401(k) or 403(b) plan, you can contribute up to the maximum in both the 457 and the other plan, and (2) if you’re 3 years from normal retirement age (as specified by the plan) and meet certain other eligibility criteria, you may have the opportunity to make a special catch-up contribution beyond the usual limits. Pretty sweet, right?! More on this below.

Before we get to the investment options that are best for you and how much you should contribute, let’s first take a look at understanding which account you should select—traditional or Roth.

Traditional vs Roth

If your company offers a 457, chances are it offers a traditional account; however, certain companies also offer a Roth account, which is less common. The difference between “traditional” and “Roth” plans is purely a difference in timing of when you pay state and federal income taxes (in addition to certain limitations on withdrawals). When you designate which percentage of your paycheck you want to contribute to your retirement account, your employer will deduct that amount from your paycheck to deposit into your retirement account. Whether or not those funds are taxed prior to deposit into your account or afterwards, when you eventually withdraw the funds from your retirement account, depends on whether your account is traditional or Roth.

Let’s take a look at the specific characteristics of traditional and Roth 457s:

Traditional 457:

- Taxes Deferred: For a traditional 457, your employer deposits your contribution directly into your retirement account tax-free. In other words, your employer withholds no taxes on this income to pay taxes on your behalf, and eventually when you file your taxes, this contribution amount will be deducted from your total taxable income.

- Taxes upon Withdrawal: Once deposited into your retirement account, your investments and their earnings (reinvested) grow tax-free until withdrawal. While you haven’t yet paid taxes on these amounts, having pre-tax investments early allows the larger amounts to compound over a long period of time. Upon withdrawal of funds from your account, you pay income taxes on both your contributions and earnings.

- Limited Access before 72: This is where 457 plans offer you a huge, unique benefit: there are no early-withdrawal penalties once you leave your employer sponsoring the plan! But if you’re still working for the same employer sponsoring your traditional 457, you cannot access the funds (unless you’re still working at age 72 – it could happen!) without paying taxes and a penalty (note there are exceptions for unforeseen emergencies and qualified loans of $5,000 or less, as discussed further below). If you withdraw funds from your account prior to this date, you will pay the applicable income taxes on the full amount withdrawn as well as a 10% penalty.

- Mandatory Withdrawals at 72: Upon reaching age 72 (age 70 ½ if born prior to July 1, 1949), the IRS requires you to withdraw at least a minimum amount each year from your account and pay ordinary income taxes on the withdrawal (the government wants some money!). If you don’t take withdrawals, or you take less than required, you’ll owe a 50% penalty tax on the difference between the amount you withdrew and the amount you should have withdrawn (yikes: go remind Grandpa!).

Roth 457:

- After-Tax Contributions: For a Roth retirement account, your employer withholds ordinary income taxes on your contribution before depositing the after-tax amount into your account. Therefore, when you file your taxes for the year, the amount contributed to your retirement account will remain in your total taxable income.

- Tax-Free upon Withdrawal: Once deposited into your retirement account, your investments and their earnings (reinvested) grow tax-free. You then pay no, zilch, nada taxes on the contributions and their earnings upon withdrawal (what a deal!).

- Limited Access before 59 ½: Once again, this is where 457 plans offer you a terrific benefit: there are no early-withdrawal penalties once you leave your employer sponsoring the plan (even if before age 59 ½)! But if you’re still working for the same employer sponsoring your Roth 457, you will be subject to penalties for any unqualified withdrawals (note there are exceptions for unforeseen emergencies and qualified loans of $5,000 or less, as discussed further below). In order for a withdrawal from a Roth retirement account to be qualified (i.e., tax and penalty-free), you must (1) have been contributing to the account for the previous 5 years and (2) be at least 59 ½ years old. However, if you must make an unqualified withdrawal from your Roth 457 while still working for your employer sponsoring the plan (not recommended!), such as when you make a withdrawal before the 5-year period or before you have reached the age of 59 ½, you only have to pay taxes and a 10% penalty on the portion of the withdrawal that represents earnings (except for certain circumstances discussed below). But this does not mean you can make an early withdrawal and designate the total amount as contributions as opposed to earnings. The IRS treats each withdrawal on a pro-rata basis, allocating taxes and penalties to each withdrawal based on the total percentage of earnings in the 457 account.

To illustrate, say you have $100,000 in your Roth 457 with your current employer, of which $90,000 is from contributions and $10,000 is from earnings on those contributions. Any withdrawals will be considered to come 90% from contributions and 10% from earnings, meaning 90% would be nontaxable and the other 10% would be taxable and possibly subject to a 10% penalty. To illustrate further, assume you’re 45 years old, you’re still working for the employer sponsoring your 457 and you’ve been contributing to your 457 for at least 5 years, and you make a withdrawal of $20,000 from your Roth 457. Of the distribution, $18,000 (20,000 x 90%) would be nontaxable and $2,000 would be taxable and potentially subject to a 10% penalty. If your tax rate is 24%, you would pay approximately $680 in taxes and fees to make this early withdrawal. However, these taxes and fees would be significantly lower than those required for early withdrawal on a traditional 457.

Note if you have a diversified (traditional and Roth) retirement plan account, you usually can choose the account from which you withdraw funds. This allows you to minimize your penalties/taxes depending on when you plan to make the withdrawals.

- Mandatory Withdrawals at 72: Similar to the traditional account, upon reaching age 72 (age 70 ½ if born prior to July 1, 1949), the IRS requires you to withdraw at least a minimum amount each year from your account. If you don’t take withdrawals, or you take less than required, you’ll owe a 50% penalty tax on the difference between the amount you withdrew and the amount you should have withdrawn (yikes: now go remind Grandma!)

The following provides a summary of the primary traditional vs Roth 457 differences:

*Mandatory withdrawal age is 70 ½ if born prior to July 1, 1949 (changed by SECURE act beginning January 1, 2020).

Early Withdrawal Penalties

As mentioned above, one of the primary differences between 457 plans and other employer-sponsored retirement plans (401(k), 403(b) and TSP) involves the early-withdrawal restrictions. These restrictions have two main differences:

- The IRS will not penalize you on withdrawals you make from a 457 once you leave the company sponsoring the 457 plan (even if you’re younger than age 59 ½).

- If you’re working at the employer sponsoring your traditional 457 plan, you cannot withdraw savings from the 457 until age 72 (age 70 ½ if born prior to July 1, 1949) without a 10% penalty (except for limited circumstances, such as an unforeseeable emergency or a qualified loan of $5,000 or less). These exceptions on early-withdrawal penalties while employed by the plan sponsor are usually more restrictive for 457 plans than those permitted by the IRS for other retirement accounts.

While advantageous compared to other retirement accounts, these early-withdrawal exceptions do not mean you should tap your 457 before age 59 ½ as soon as you leave an employer. A 457 is a tax-advantaged retirement account and should be a prioritized savings vehicle due to the tax savings it provides.

Which One to Choose – Traditional or Roth?

There’s an ongoing debate and many example calculations about which is better: traditional or Roth. Most people will tell you a Roth retirement account is the better option, if available. But this is not necessarily true. Your choice should really depend on your circumstances and, specifically, how much higher (or lower) you think your tax rate will be during retirement.

Those in favor of the Roth account claim the small tax bill upfront—in exchange for what would otherwise be an undoubtedly larger tax bill later—provides more tax savings and prevents you the burden of, and uncertainty in, paying taxes at retirement. On the other hand, those in favor of the traditional account claim these plans allow you to invest more now (assuming you haven’t reached the annual contribution limit) from pre-tax dollars which will experience compound growth and in many cases create a higher after-tax return than a Roth account. Decisively determining which plan is best for you requires a detailed calculation with many assumptions regarding your income and tax rate at retirement. I don’t know about you, but (a) I don’t have a clue what my retirement income will be and (b) I don’t really feel like paying a financial adviser to guess my future situation either.

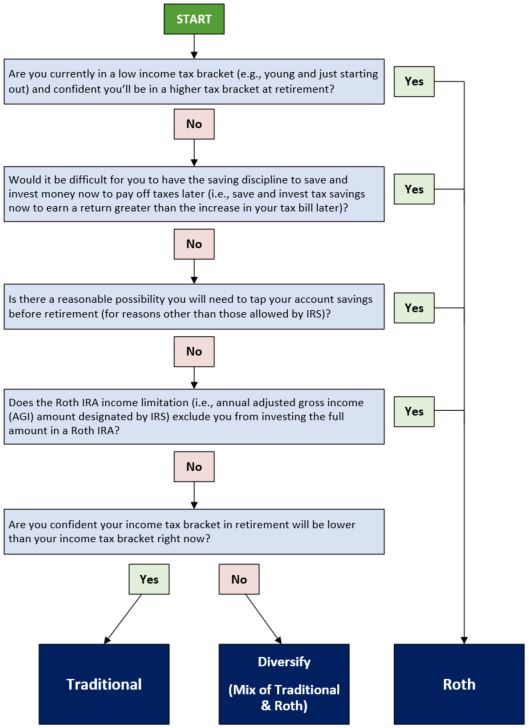

The diagram below simplifies the traditional vs Roth 457 decision for you (note there is a different decision tree for traditional vs Roth IRA). This decision matrix is not perfect, but it will give you a good reference point on which you can base your decision.

As shown above, if you don’t confidently know whether your income tax rate will be higher or lower in retirement than it is today, it would be wise to hedge your bets and split your contributions between a traditional and Roth 457. Keep in mind, however, you’ll still be capped at $19,500 (or $26,000 if you’re age 50+) for your total annual contributions (e.g., $9,750 to traditional and $9,750 to Roth).

Employer Match

Other than tax savings, the other huge benefit of a 457 is the potential employer match. This is free money, people! Many employers offer to match your 457 contributions up to a percentage of your salary as a way of encouraging you to contribute to your plan. In particular, an employer match is part of a company’s benefits package to you; so when you’re job hunting, it’s worth considering the percentage at which prospective employers match retirement account contributions.

Just as with your other retirement plans, if your employer offers a match, your first priority after establishing your immediate obligation and emergency funds should be to contribute to your 457 the maximum percentage of your salary at which your employer will match.

IMPORTANT: Because employer contributions to 457 plans reduce the IRS annual limit of 457 contributions, some employers opt to not match 457 contributions but rather offer a separate 401(a) plan to provide employer contributions. If this is the case, make sure you obtain the maximum employer contribution in your 401(a) plan.

One of the biggest mistakes you can make, especially for those of you just starting your careers, is not contributing the maximum percentage of your salary at which your employer will match. What does this mean? Frequent employer match terms are as follows: the employer matches 50% of employee contributions on the first 6% of salary the employee contributes. In this situation, you would want your contribution percentage to be at least 6%.

To illustrate, assume Johnny works for a company offering the matching terms stated above (match of 50% on first 6% of salary the employee contributes). His salary is $50,000, and he has elected to contribute 10% of his salary to a traditional 457 plan. Each year, Johnny would contribute $5,000 (10% of his salary) to his 457 plan. In addition, each year, Johnny’s company would contribute $1,500 (50% x 6% x $50,000) to his 457 plan. The total yearly contribution made to Johnny’s 457 would be $6,500. Note even though Johnny contributed 10% of his salary, the company only matches 50% up to 6% of his salary.

Assume the same circumstances for Johnny except now he decides to contribute only 4% of his salary to his 457 plan. Johnny would contribute $2,000 (4% of his salary), and his company would contribute $1,000 (50% x 4% x $50,000). Johnny missed out on $500 in free money by not contributing another 2% of his salary! Boooo Johnny! To sum up, the minimum Johnny should contribute to his 457 plan is 6% of his salary.

Some companies will match dollar-for-dollar on all contributions by an employee, though this is rare. Other companies unfortunately do not match at all. It’s important for you to know (or ask) up to what percentage of your salary your employer will match as this is the minimum contribution you should make to your 457 each year.

Lastly, strongly consider whether you have “vested” in your employer’s retirement plan match before leaving a company. “Vesting” refers to the delay in an employee’s ownership of company benefits for a specified number of years to incentivize the employee to remain at the company. You immediately vest in your own contributions, but usually companies require a vesting period for employer contributions (i.e., the employer match). You should be able to determine the vesting period, if applicable, by reading your plan’s terms or contacting your company’s HR department.

How Much to Contribute

Clearly it’s important to contribute at least the percentage of your employer’s match, but exactly what percentage of your salary should you contribute? For 457 plans, this answer isn’t quite as simple.

After checking off your first four priorities (immediate obligation fund, emergency fund, maximizing employer match and paying off high-interest debt), your focus should be on funding your retirement accounts, including your 457. However, after contributing the percentage to maximize your 457 employer match, you should consider all your retirement account options.

Specifically, after establishing your 457 contribution percentage to receive the maximum employer match, take a step back and assess whether your 457, IRA or options outside of a 457 (refer to Options outside 457 section, below) would offer the better investments for your retirement portfolio. Oftentimes your IRA will be the better choice here as you will have more options to select an investment in line with your desired portfolio and at a lower cost (i.e., expense ratio). If this is the case, (i) invest enough in your 457 (and 401(k)/403(b), if applicable) to get the maximum match, then (ii) invest in an IRA up to the established IRA limit, and then (iii) invest any remainder up to the 457 IRS limit (or other options outside of the 457, as discussed below).

If your employer does not offer a match, prioritize investing in an IRA up to the established IRS limit (assuming an IRA offers better investment options at a lower cost). Then invest any remainder in your 457 up to the IRS limit (or other options outside of the 457, as discussed below).

With the above guidance in mind, most experts recommend 10% of your salary as a good starting point, but even many frugal, savvy, young professionals contribute 25% to even 30% of their salaries. These percentages should not be your reference point, however; first get through your first four priorities and determine how much money remains. As all contributions must originate as deductions from your paychecks, you won’t be able to deposit this amount directly into your retirement account. Rather, you’ll need to set a contribution percentage (this requires some math and guessing on your part) for your employer to deposit the designated percentage of your paycheck directly into your 457 account. Note this contribution and the percentage you choose will be recurring for every paycheck (until changed), but you can change the contribution percentage as often as you would like.

Determining the right contribution percentage can involve some trial and error. Thus, you should adjust your contribution percentage as often as necessary to get a sense of the appropriate percentage for you, especially if you start with a percentage much higher than you will be able to sustain. Remember, however, to not be overly conservative on your contribution percentage: if you have extra cash sitting in your checking or savings accounts (unrelated to your immediate obligation or emergency funds), that money could be sitting in your retirement account reaping the wonderful tax and match benefits (assuming you haven’t already surpassed the contribution limit).

457 Contribution Limits

If a 457 plan is the only tax-advantaged retirement plan your employer offers, the annual contribution limits are the same as those for a 401(k), 403(b) and TSP – that is, $19,500 in 2021 for those under 50 years old and $26,000 for those 50 years and older. But here’s another way 457 plans can be awesome: if your employer offers a 457 plan in addition to a 401(k) or 403(b) plan, you can contribute up to the maximum in both the 457 and the other plan. However, one important caveat to these contribution limits relates to employer contributions. Unlike those to a 401(k) or a 403(b) plan, employer contributions to a 457 plan reduce the annual limit per the IRS; therefore, the limits above apply to the aggregate of employee and employer contributions. Still, this means you (and your employer) could make a total retirement contribution, including both of your 457 and 401(k) or 403(b), of as much as $39,000 (or $52,000 if you’re 50 years or older) in 2021. Wow!! Now that’s a lot of retirement moolah!

In addition, if permitted by your particular 457 plan, you can be eligible for special 457(b) catch-up contributions if you’re 3 years prior to the normal retirement age (as specified in the plan). In particular, if you are eligible and 3 years from normal retirement, you can contribute to your 457 the lesser of:

- Twice the annual limit (i.e., $39,000 in 2021) or

- Basic annual limit plus the amount of the basic limit not used in prior years (only allowed if not using the age 50+ catch-up contributions)

To make all this less complicated, at the very least, you should invest enough to receive the full matching amount that your company pays to match your contributions. This is the freest (yes, that’s a word) money you will ever receive, so do not forget this very important advice.

Which Investment(s) Should I Choose?

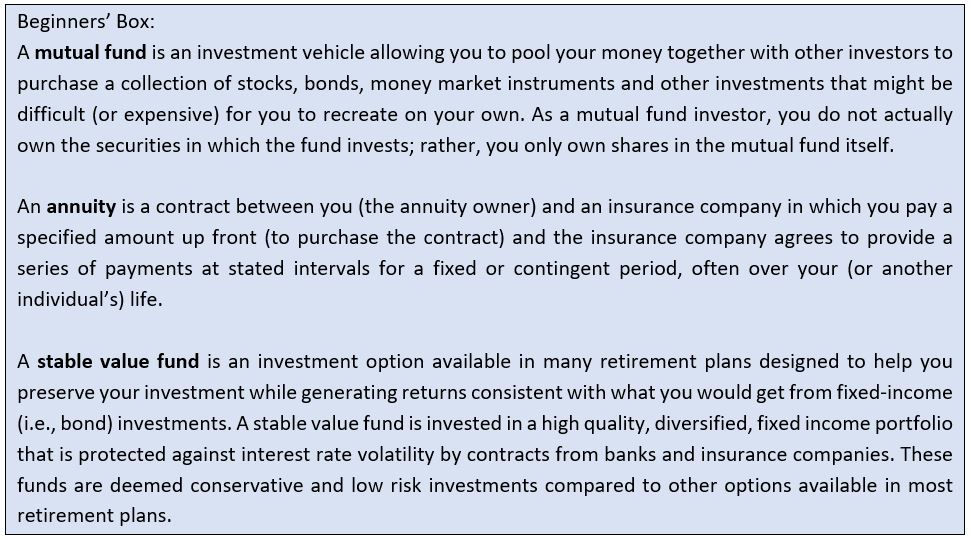

Similar to employers of 403(b) plans, employers of 457 plans often allow multiple administrators to administer the plans. If a 457 is a governmental plan, the plan’s available investment options are subject to requirements under state laws. Otherwise, 457 plans generally allow plan participants to invest in a wide range of investments, including mutual funds, annuities and stable value funds. While typically not matching the investment choices and costs of 401(k) plans, 457 plans generally offer a better slate of investment options, including a wider variety with lower cost, than 403(b) plans.

Some employers are notorious for not providing detailed information on your 457 plan administrators and their respective investment options. If this is your case, the first step is contacting your organization’s benefits contact/department to obtain a copy of the summary plan description (which companies are now required to maintain). Based on this plan description, you should be able to identify a list of administrators and their respective investment options. To analyze your available investments, you’ll need to evaluate information on each investment’s strategy, performance and expense ratio. Hopefully your employer’s administrator(s) have already provided or can easily provide this information to you.

If available, mutual funds, and in particular target-date funds, are usually your best diversified, low-cost option. True to their name, target-date funds are mutual funds including a combination of stocks and bonds that gradually become more conservative as you reach your target-date of retirement. For instance, a 25-year-old in 2020 planning to retire at age 65 would invest his/her 457 in a 2060 target-date fund. Target-date funds generally have fairly low expense ratios and make your investing responsibilities SIMPLE as they take no effort by you to continuously update your 457 portfolio. This simplifies your investing and allows you to focus your time and energy elsewhere!

Annuities might seem attractive due to their “guaranteed” returns, but annuities usually result in higher taxes, higher fees/expenses, and specific restrictions hidden in details. To elaborate, when you withdraw money from an annuity, the gains are taxed as ordinary income (as high as 37% at the federal level), whereas gains on mutual funds held at least one year are taxed as long-term capital gains (15% for individuals in most tax brackets). In addition, as annuities are insurance products sold by salesmen making money on commissions, total fees and expenses (including commission fees and other annual fees) are oftentimes double or triple the size of those for mutual funds. Finally, annuities oftentimes include certain restrictions hidden in prospectus details, such as higher penalties for early withdrawals or minimum investment allocations.

Stable value funds offer you low-risk investment options. But with this low risk comes low returns, so these investments should generally not make up the bulk of your investment portfolio.

When would annuities or stable value funds be the better option? In short, when you’re very risk-averse (such as close to retirement) and want more predictable, albeit lower, income (including those concerned about outliving their funds). Annuities may also make sense if you’re looking for long-term care benefits or an equivalent to life insurance if you’re not eligible for these insurance benefits.

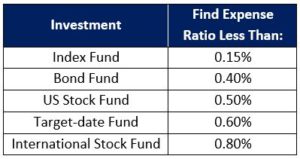

Finally, make sure you pay particular attention to investment expense ratios. An expense ratio is an annual fee representing the percentage of your investment that goes toward the costs of running a fund. For example, if you invest in a mutual fund with an expense ratio of 1%, you will pay $10 for every $1,000 invested each year. Over time, these fees can significantly drag down your investment returns, so it’s very important to pay attention to these ratios. Considering expense ratios is even more important for 457 plans as the range of expense ratios and fees for your investment options can be substantial. Some 457 investment options can have fees over 2% per year and other high fees for early withdrawals (known as “surrender charges”). Others, such as those offered by Fidelity, Vanguard or TIAA-CREF, charge as low as 0 to 0.20% per year with no surrender charges. You will want to select an investment option in line with your desired investment portfolio with the lowest expense ratios and no/lowest surrender charges. As expense ratios vary depending on the type of investment and the cost to run the respective fund, generally you will want to select investments based on the following expense ratio criteria:

Setting up your 457:

The process to set up your 457 plan should be very consistent with your 403(b) plan. Before your start date or soon thereafter, your employer should provide you a summary description of the plan, including a list of available plan administrators/investments and a link or instructions to access your benefits account and update your contribution percentage. If your employer does not provide these instructions or information about your benefits on or soon after your start date, contact the company’s HR department to ask about retirement account plans and associated instructions available to you. Employers offering 457 plans usually hire multiple administrators to oversee the 457 plan. If you have a choice between multiple administrators, make sure you evaluate both the administrator and its respective investments to determine which administrator has the best reputation and investment options for you (i.e., based on investment strategies, performance and expense ratios). Once you identify your plan administrator, access the administrator’s website (via a link or instructions from your employer) to create an account on the administrator’s website or fill out a form to provide to your employer/administrator. Once you create an account, you will be able to select your 457 contribution percentage and the investments in which you will invest.

Once you have finalized your contribution percentage and investments, your employer will automatically deduct the funds from your paycheck to invest in the 457 on your behalf. You can monitor your 457 balance by logging into your account via the administrator’s website. If you have questions about your 457 balance/investments or want to shift money around, contact your 457 plan administrator.

Options outside 457

Considering the variability of investment choices and fees/expenses of 457 plans, you should consider if you have a better option outside of your 457 plan. If you’re eligible to participate in a 457 plan, you may be eligible to participate in the following other plans instead:

- 403(b) Plan:

A 457 plan is considered a “supplemental” retirement plan to the 403(b). Despite having similar tax-advantages as 403(b) plans, 457 plans generally have more investment options with lower costs, potentially higher contribution limits and more lenient early-withdrawal restrictions/penalties. However, you should still research your 403(b) plan to determine whether it offers better investment options and expense ratios. Refer to the post on 403(b) plans for further information.

- 401(a) Plan:

A 401(a) plan is another “supplemental” retirement plan to the 403(b). I know what you’re thinking…not more letters and numbers! Good news: you don’t need to remember too many more of these plan names. 401(a) plans are custom-designed money-purchase retirement plans usually only offered to key government, educational institution and nonprofit organization employees. These plans allow contributions by the employee, the employer or both; whereas employer contributions are mandatory, employee contributions can be voluntary or mandatory (i.e., irrevocable election of a certain dollar amount or percentage – be very, very cautious when considering this!).

Employers have much more control and discretion over 401(a) plans than they do for 401(k), 403(b) and 457 plans. In particular, employers usually set the employee and employer contribution limits (by dollar or percentage of pay), whether employee contributions are mandatory or voluntary and pre-tax or after-tax, the different investment options, eligibility criteria and vesting schedules. Employers can even create multiple 401(a) plans, each with different eligibility criteria and saving conditions. Due to this employer discretion, 401(a) plans can widely vary in their contribution limits, investment choices and terms, and the employee generally does not get to decide how much money goes into a 401(a) account.

As these plans can vary widely based on employer discretion, you should closely research the terms and conditions of your 401(a) plan, if offered. This is especially important as you will want to obtain the maximum employer contribution (in your 401(a) plan as well as all other plans) before investing in another qualified retirement plan.

If your employer offers multiple plans, be sure to assess any mandatory contributions, the investment options, the investment costs and the relevant conditions of each plan. You should prioritize your plans to first obtain the maximum of any employer match/contribution and then invest your remaining retirement savings into the plan with the best, lowest-cost investments. This could require some hefty research on your part, but it will be worth it!

If you’ve already started investing in your 457 and are considering moving your money to one of the options above or another investment, be careful!! Strongly consider whether you will need to take advantage of the zero early-withdrawal penalties after leaving your employer (which will no longer apply if you transfer these funds from your 457 to another plan, such as an IRA). In addition, investments in retirement plans may have expensive surrender charges, so make sure you review your retirement plans and even contact the administrator to determine what fees or penalties would be imposed on you if you transfer your investments to another plan.

For any other 457 questions, feel free to leave a comment!

References

- www.tsp.gov

- https://www.usaa.com/inet/wc/advice_deployment_menu?wa_ref=pri_global_lifeevents_deploy&akredirect=true

- https://www.tsp.gov/PDF/formspubs/tsp-536.pdf

Wish my employer offered a 457 🙁

That’s too bad. At least you know your other options now 🙂

I would never be able to max out my 457 and 403(b), but good to know that’s an option. Good post

You never know! Thanks for reading, Shannon

Why dont all plans have zero fees when you leave your job

That would be nice, wouldn’t it? The IRS slammed that door shut. They’re hoping to incentivize us to leave those retirement savings untouched

Excellent!

Thank you!

Really helpful. You have more info than Nationwide

Thanks, Colin!

Insightful and entertaining

Thanks, Lacey. Feel free to subscribe!

My financial advisor recommended that I move my 457 to my IRA. Now he is no longer my financial advisor

Yikes. Hopefully you didn’t move it! Another example of why we need to be careful with financial advisors (and challenge them when you think they’re wrong)