With everything going on in your busy life, it’s challenging to know where to start when it comes to your finances. Look no further: this article has you covered.

Before you can make any rational financial decisions, step one is understanding where you’re at right now. Are you Scrooge McDuck swimming in a pool of cash, or are you on the verge of selling your kidney to pay off some debt? After we nail this down, we’ll cover the eight financial priorities you should use as your financial roadmap.

Your Current Financial Status

Before you can make any rational financial decisions, step one is understanding where you’re at right now. Are you Scrooge McDuck swimming in a pool of cash, or are you on the verge of selling your kidney to pay off some debt?

To make this assessment, compare what you own vs what you owe. If you’re feeling crazy, even write it down, drawing a line down the middle and labeling the left, “Things I Own (Assets),” and the right, “Debts (Liabilities)”:

For the left side, take a general inventory of everything you personally own: money in bank accounts (e.g., checking and savings accounts), any money in retirement accounts (e.g., 401(k) and IRA), other investments, your car, your jewelry, your home (estimate of current market value), etc. For the right side, list your outstanding debt: credit card debt, outstanding student loans, outstanding car loan, remaining mortgage, etc. Don’t worry about making these amounts exact; estimates are fine. You just want to have a mental “picture” of your current financial status. If you have a partner or dependents (e.g., children), include their assets and liabilities as well.

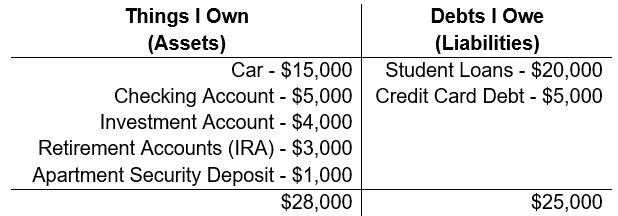

Consider the following hypothetical example for Caroline, a recent graduate who owns her own car and is renting her first apartment:

In this example, Caroline has $28,000 in assets and $25,000 in liabilities. The difference between these two amounts (i.e., assets – liabilities) is her net worth (also known as “equity”). In this example, Caroline’s net worth is $3,000.

Based on your personal balance sheet, do you have more assets than liabilities (i.e., positive net worth)? Or do you have more liabilities than assets (i.e., negative net worth)? By how much? As a recent graduate, don’t be disheartened if you have negative net worth as that can be expected with few assets and high student loans.

Finally, consider how much cash you have and any assets you would be able to quickly convert into cash (a concept known as liquidity). For instance, if Caroline had to make an emergency cash payment of $10,000 for an unexpected hospital visit, does she have cash readily available to make the payment? The money in her checking account is cash, but that’s only $5,000. Caroline may be able to sell the $4,000 of investments in her investment account for cash, but she would still need to find another $1,000. This is not an ideal scenario as her car and security deposit are illiquid, and Caroline generally wouldn’t want to tap her retirement accounts or rack up credit card debt. For this reason, it’s important to consistently assess the amount of cash you have at your disposal in case an emergency arises.

Smart Priorities

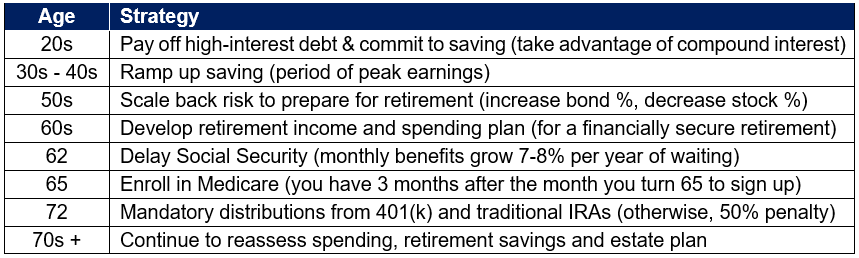

Your financial priorities will transition over the different stages of your life. After high school or college, in addition to finding a rewarding job, you generally want to establish an emergency fund, pay off debt and start saving. Gradually, as you (hopefully) establish your career over your 30s and 40s, you want to ramp up your savings. During your 50s, as you approach retirement, you want to continue saving but scale back on risk to avoid a large loss just before retirement. Beginning in your 60s, you want to evaluate Social Security/Medicare timing and manage the retirement savings you’ve been accumulating since your 20s. Then, during retirement, as Jimmy Buffet says, you can waste away in Margaritaville.

General, recommended strategies by age are as follows:

Obviously, life doesn’t always go as expected. Everyone’s circumstances are different, and one moment or event can completely change these strategies. For instance, if you have a child or family member in need of significant healthcare expenses or if you must spend money to support the well-being and/or survival of a loved one, that will clearly take precedent. Always put things in perspective. Understand these are general guidelines and not the perfect strategy for each individual or family.

With this in mind, however, there are financial priorities you should follow regardless of your age. These priorities, which are numbered in sequential order from one to eight, will help you prepare for emergencies, avoid high-interest debt and save the most money for a financially secure future.

- Cover immediate necessities and minimum debt payments.

- Save $1,000 for initial emergency fund.

- Maximize employer match.

- Pay off all high-interest-rate (6% +) debt.

- Save full emergency fund.

- Invest in tax-advantaged accounts.

- Pay off remaining debt (except mortgage).

- Invest in non-tax-advantaged accounts.

Let’s take a look at each of these eight priorities:

Priority 1: Cover immediate necessities and minimum debt payments.

Your first financial priority—before paying off debt, saving for retirement or otherwise investing—is to save enough money to cover your immediate necessities until your next paycheck or source of income. This includes paying both your ongoing bills (e.g., rent, food, utilities, transportation, ragers, whatever) and your minimum payments on ALL debt.

The purpose of this first priority, other than providing you with life’s bare necessities, is to prevent you from going any further into debt. If you have no debt, awesome: continue to PAY YOUR BILLS (we’re trying to move forward here, people). If you do have debt, making the minimum payments, despite leaving you vulnerable to compound interest on the remaining balance, at least keeps your account in good standing and helps you avoid late fees and severe damage to your credit score.

The amount you need to set aside to cover these immediate necessities depends on both your current living expenses and your expected near-term income. Someone who rents a Southern California beachside penthouse, gets paid twice a year and makes it rain with $100 bills every Friday night (not judging) is going to need a whole lot more set aside than someone who has a steady paycheck, rents a buddy’s floor for $10 a month and survives on ramen noodles. For most, the amount to set aside should be around one month of living expenses.

Priority 2: Save $1,000 for initial emergency fund.

Next on your list is to start saving for emergencies (yes, more saving, already). The amount you saved for immediate obligations in Priority 1 doesn’t actually prepare you for emergencies or unexpected expenses; rather, it’s just large enough to get you to your next paycheck. An emergency fund ensures you have cash on hand when faced with a loss of job or unexpected expense—such as car maintenance, medical bills or home repairs—which would otherwise force you into more debt.

The general guideline with emergency funds is that you should save enough to cover three to six months of living expenses. However, for many, especially those living paycheck-to-paycheck, saving that amount can be like running a marathon after chaffing on mile 1. So that you don’t delay the benefit of the next few priorities, stick to setting aside an initial emergency fund of $1,000. This way you have enough to cover minor emergencies, such as a routine car or home repair, without racking up credit card or other high-interest debt.

Priority 3: Maximize employer match.

If your employer offers an employer-sponsored retirement account—such as a 401(k), 403(b) or similar plan—make sure you take advantage of any employer match. For these retirement plans, many employers offer to match your contributions up to a percentage of your salary. This is FREE MONEY! People stampede over one another to get to free food, but many don’t bother with the limited effort to score free money from their employers: it’s mind-boggling.

One of the biggest mistakes you can make as you start your career is not contributing the percentage of your salary at which your employer will match. What does that mean? As an example, your employer may match 50% of your contributions on the first 6% of salary you contribute. In this situation, you would want your contribution percentage to be at least 6%. It’s important for you to know (or ask) up to what percentage of your salary your employer will match as this is the minimum contribution you should make to your employer-sponsored retirement plan each year. For now, in Priority 3, focus on setting up automatic contributions at this minimum percentage. Later, in Priority 6, you’ll want to increase that contribution percentage to fully take advantage of the tax benefits of these accounts. More on this in Chapter 2: Saving and Retirement Accounts.

Priority 4: Pay off all high-interest-rate (6% +) debt.

High-interest debt is the devil of the financial world itself. Not only do you pay an exorbitant amount of interest on these loans, but maintaining a balance will require you to pay interest on interest, causing your debt to compound quickly and spiral you into a financial hole that can take decades to pay off. To help put this in perspective, consider the following:

Say you have a $5,000 outstanding balance on a credit card and your penalty interest rate is 29%. Surely waiting one year to pay it off won’t matter much, will it? WRONG! Assuming interest compounds daily, that’s over $1,600 in extra interest, bringing your new balance to more than $6,600. Think of all the other things you could do with $1,600.

For this reason, your next priority is to pay off all your high-interest debt (i.e., debt with an interest rate of 6% or higher), starting with the debt with the highest interest rate. If you have no high-interest-rate debt, keep up the good work, pass GO and move on to Priority 5. Otherwise, keep reading.

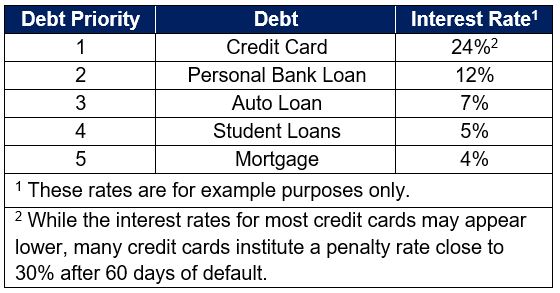

Interest rates can vary significantly for a variety of reasons, such as the term of the loan, your credit score, supply and demand in the market and the debt instrument itself. To assess the rates that apply to you, make a list of your outstanding debt with their corresponding interest rates (note that the rate can usually be found on your monthly statement). Then place them in order from highest to lowest: this is your debt payout priority schedule. For example, yours may look as follows:

Once you have your debt payout priority schedule, draw a line to separate any debt with an interest rate greater than 5% from any debt with an interest rate of 5% or less. You’ve now just separated what we’ll consider your “high”-interest-rate debt (Priority 4) vs your “low”-interest-rate debt (Priority 7). Why 6% or greater? Historically (not guaranteed), you can earn at least 6% over the long-term by investing your money in a diversified portfolio or tax-advantaged retirement account. We’ll cover more on rates of return in Chapter 3: Investing; for now, focus on paying off your high-interest-rate debt in FULL.

Note: Many people are tempted to pay off their smallest debt balance first; however, while this provides a mental reward and maintains your debt-paying momentum, you can strategically pay the least amount of total interest by paying off your highest-interest debt first (while making minimum payments on the others). It’s important to emphasize that this strategy requires commitment: if you lose confidence or momentum and neglect to continue paying off the highest-interest debt, your interest payments will only get worse.

To be clear, Priority 4 is not easy. It will require discipline and a strong commitment to your budget, even if it takes several years to clear this hurdle. But, as you will hear over and over again, this step is critical to your financial well-being, which is why it immediately follows your initial savings and employer match. With this in mind, if you can decrease the cost of your immediate necessities, put the extra money to paying off your highest-interest debt. You will “earn” much more in avoided interest than you can earn by keeping that cash in your wallet or bank account. Stay dedicated, stay motivated and get rid of that pesky debt once and for all.

Priority 5: Save full emergency fund.

Once you’ve paid off all high-interest debt and doused yourself in champagne to celebrate, prioritize building up your emergency fund. Remember: you got a jumpstart on this by saving $1,000 in Priority 2, but now you need to supplement it with enough to cover three to six months of living expenses. The specific amount depends on your own circumstances: if you’re risk averse or only have one source of income, target six months of expenses; otherwise, closer to three months is fine. The goal is to be comfortable that you have enough stocked away to avoid compiling debt should you suddenly face an unexpected expense or lose your job.

Priority 6: Invest in tax-advantaged accounts.

Opinions may be divided more than ever these days, but we can all agree on one thing: taxes are the worst. No one likes paying them, no one likes filing tax returns and no one likes the IRS breathing down their throat telling them they owe more. Yet, when the government offers opportunities to pay less in taxes via tax-advantaged accounts, many people inconceivably don’t take advantage of them. That’s like telling Santa to go back up the chimney because you don’t want his presents…bunch of Grinches.

There are many different types of tax-advantaged accounts, with some of the most common including retirement accounts (e.g., 401(k) and IRA), education savings accounts (e.g., 529 and Coverdell) and healthcare savings accounts (e.g., HSA and FSA). Each of these accounts allows you to reduce your tax burden, which can be a discount of 15% for most or even upwards of 40% or more for others. When you consider the amounts at stake for these categories, particularly when those amounts get compounded over time, the savings are MASSIVE.

Note: Certain employers offer other reimbursement accounts, such as dependent care reimbursement accounts or pre-tax commuter benefits, which allow you to pay for qualified expenses tax-free. Be sure to do your research and check with your employer on the options that are relevant and available to you.

Out of all the tax-advantaged accounts referenced above, pay particular attention to your retirement accounts. If you started contributing to your employer-sponsored plan in Priority 3, you’ve already started this step. But…and try to contain your excitement…there’s more.

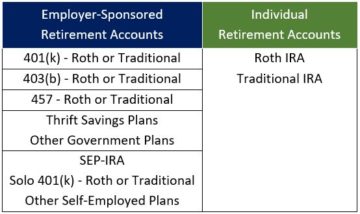

Tax-advantaged retirement accounts include the following two separate groups of accounts:

You want to invest in BOTH an employer-sponsored retirement account and an individual retirement account, if eligible.

The plans on the left are employer-sponsored retirement accounts, so these plans are limited to those of you employed by companies or agencies that offer such plans. Check with your employer to determine whether any of these plans are available to you.

The plans on the right are individual retirement accounts (IRAs). (Technically, their official name is individual retirement arrangement, but no one really calls them that). Whereas the plans on the left are employer-specific, anyone who has earned income can contribute to an IRA. Therefore, assuming you’ve reached this priority and have income, you have no excuse to not invest in an IRA each year.

Be aware that the IRS establishes certain limits on how much you can contribute to these plans each year. Priority 3 focused on the minimum amount you should contribute to your employer-sponsored retirement plan to maximize any employer match. Now, in Priority 6, contribute to both your IRA and employer-sponsored plan up to the designated annual limits.

Beyond tax-advantaged retirement accounts, you should also take advantage of other tax-advantaged accounts if (1) you’re eligible, (2) you’re confident your emergency fund and other savings will prevent you from tapping these accounts early and (3) you plan to spend money on the plan’s allowable expenses in the future. Remember: each of these tax-advantaged accounts provides you with considerable savings, so do not miss these golden opportunities.

Priority 7: Pay off remaining debt (except mortgage)

Deciding between the next two priorities (7 and 8) requires some judgement on your part. You need to ask yourself which will be higher: the interest rate on your debt (e.g., 5% on your student loans) or the rate of return on potential investments. The simple answer, and the answer which I recommend, is to pay off the remaining balance on all low-interest debt before investing in tax advantaged accounts. (Note the one exception to this is your mortgage, which generally has a lower interest rate and tax incentives). The reason? Debt interest is a guaranteed “return,” whereas investing in the market is far from guaranteed.

For instance, assume you have savings of $20,000 and have outstanding student loans of $20,000 with an interest rate of 5%. If you pay off your student loans in full, you’ve guaranteed yourself a return of 5% (tax considerations aside) by removing that interest payment in the future. Say instead you decide to invest the $20,000 in the stock market and the market tanks 30% (yes, this is possible: stocks dropped around 37% during the 2008 market crash, even though they more than recovered within a few years later). Now, not only do you still have $20,000 of student loan debt on which you owe 5% each year, but you lost $6,000 in the stock market. This is an extreme example, but this goes to show the value in paying off “guaranteed” returns.

Priority 8: Invest in non-tax-advantaged accounts.

Reach this point and you officially have a solid financial foundation. You’ve set aside key savings, paid off all debt and maxed out your annual retirement account contributions. But this doesn’t mean you should disappear to la-la land and ignore any future money decisions.

Considering inflation increases on average 2% each year (or much more, as we’ve seen in the early 2020s), if you store all your money in your mattress or a savings account earning 0.1% interest, you will actually lose money over the course of your life (i.e., your money will lose its purchasing power). Therefore, you must invest. Investment options range from safer investments such as money market funds, certificates of deposit (CDs) and bonds to risky investments such as stocks, real estate, derivatives, hedge funds, crypto and other alternative investments. Your goal should be to have a low-cost, diversified investment portfolio. We will conquer the topics of how to invest, how much to invest and what you should invest in within Chapter 3: Investing.

Subsequent Priorities

Once you master these eight priorities, you can focus on saving for your children’s education, building wealth, planning your estate and giving back to others. Whew! Adulting is exhausting. Yet if you can pay off all your debt and start investing, you’re well on your way.

This needs to be in money textbooks

Thank you, Elisabeth. I agree!

Sharing with my class!

Glad to hear it, Alec. Please keep sharing!

I’m a big fan of Investopedia but even they don’t have something this straightforward

Thanks, Fran! Straightforward is what I’m going for with this

Priorities 1-7: Don’t spend money you don’t have

That’s certainly important. Thanks for reading!

Excellent

Thanks again, Nancy

If only it were this easy. Most of us are stuck in Priority 1

Fair point, and you’re definitely not alone. Remember to keep priority 2 in mind whenever you have the opportunity to escape priority 1. Good luck, and thank you for reading!

Hi! I’m a mentor for underprivileged youths and shared this – they loved it! Thank you for sharing

That’s great, Genny. Thank you for the support!

I disagree with paying off ALL low interest rate debt before investing in non-tax advantaged accounts. There’s a lot of benefit in having low interest

Thanks for the comment, Ted. I agree there are limited tax benefits to having mortgage interest deductions, but I wouldn’t say there is “a lot of benefit” in having debt low interest. Whether you should pay off ALL low interest rate debt before investing in non-tax-advantaged accounts depends on whether you are confident you will receive a return greater than the interest rate on your debt. I recommend paying off your debt because the debt interest rate is guaranteed. However, before paying off all low interest rate debt, I do recommend investing at least a little in your tax-advantaged retirement accounts to begin saving for retirement, obtain any employer match and establish those saving habits

Homework assignment for my children to read. Thanks 🙂

Thanks for the support and for passing it along!

This is a great article. Particularly helpful when considering the trade offs of paying off debt vs saving. Enjoyable read too..please keep them coming!

Thank you for the support! I will absolutely keep them coming

Good and helpful summary. More people need to read this!

Thanks, Josh. Please share with family and friends!

Good way to step back and think about your finances. Nice piece

Thank you!

My daughter just read this and won’t comment, but she really liked it!!

Haha thank you, and thank your daughter!

This is so much more helpful than other financial advice

Thanks, Anjana! Appreciate the support!

First place anyone should go to consider their finances

Thanks Ella!

Credit card rates that high should be illegal. US government get on it

I actually agree, but that will be hard to get through Congress. Thanks for reading!

Every student should be required to read this. Schools do not teach personal finances enough!

My balance sheet is uh.ga.ly.

Haha at least you know what you’re working with

This was entertaining

Thanks, Emma

Great post

Thanks for reading!

Excellent advice follow these rules to live a better and balanced life