We arrive at the major debate—no, not Trump vs Biden or which way to hang toilet paper. This one shouldn’t get people all riled up: should you choose a traditional or Roth work retirement plan? This post makes the traditional vs Roth decision for employer-sponsored retirement plans as easy as possible (Note there’s a separate post for making this decision for IRAs).

The difference between “traditional” and “Roth” plans is purely a difference in timing of when you pay state and federal income taxes (in addition to certain limitations on withdrawals). When you designate which percentage of your paycheck you want to contribute to your retirement account, your employer will deduct that amount from your paycheck to deposit into your retirement account. Whether those funds are taxed prior to deposit into your account or afterwards, when you eventually withdraw the funds from your retirement account, depends on whether your account is traditional or Roth.

Let’s take a look at the specifics of each, starting with traditional:

Traditional 401(k), 403(b), 457, TSP, Solo 401(k), SEP IRA and SIMPLE IRA

- Taxes Deferred: For a traditional retirement plan, your employer deposits your contribution directly into your account tax-free. In other words, your employer withholds no taxes on this income to pay taxes on your behalf, and when you file your taxes for the current year, this contribution amount will be deducted from your total taxable income.

- Taxes upon Withdrawal: Once deposited into your retirement account, your investments and their earnings (reinvested) grow tax-free until withdrawal. While you haven’t yet paid taxes on these amounts, having pre-tax investments early allows the larger amounts to compound over a long period of time. Upon withdrawal of funds from your account, you pay income taxes on both your contributions and earnings.

- No Access before 59 ½*: For all contributions and earnings in a traditional account, you cannot access the funds before age 59 ½ without paying taxes and a penalty (except for certain circumstances discussed below). If you withdraw funds from your account prior to this date, you will pay the applicable income taxes on the full amount withdrawn as well as a 10%** penalty

- Mandatory Withdrawals at 72: Upon reaching age 72 (age 70 ½ if born prior to July 1, 1949), the IRS requires you to withdraw at least a minimum amount each year from your account and pay ordinary income taxes on the withdrawal (the government wants some money!). If you don’t take withdrawals, or you take less than required, you’ll owe a 50% penalty tax on the difference between the amount you withdrew and the amount you should have withdrawn (yikes: go remind Grandpa!)

*For a 457 plan, the 10% penalty does not apply to distributions once you leave your employer sponsoring the plan (even if before age 59 ½), have an unforeseen emergency, take a qualified loan of $5,000 or less, or reach age 72 (age 70 ½ if born prior to July 1, 1949) while still employed.

**SIMPLE IRA withdrawals incur a 25% additional tax instead of 10% if made within the first 2 years of participation.

Now let’s get to the Roth account, named after Senator William Roth of Delaware when he helped establish the Roth IRA via the Taxpayer Relief Act of 1997 (Roth employer-sponsored retirement accounts didn’t come around until 2006).

Note that a Roth account is not available for SEP IRAs or SIMPLE IRAs, so your decision is already made for those.

Roth 401(k), 403(b), 457, TSP and Solo 401(k)

- After-Tax Contributions: For a Roth retirement account, your employer withholds ordinary income taxes on your contribution before depositing the after-tax amount into your account. Therefore, when you file your taxes for the year, the amount contributed to your retirement account will remain in your total taxable income

- Tax-Free upon Withdrawal: Once deposited into your retirement account, your investments and their earnings (reinvested) grow tax-free. You then pay no, zilch, nada taxes on the contributions and their earnings upon withdrawal (what a deal!)

- Flexible Access before 59 ½*: In order for a withdrawal from a Roth retirement account to be qualified (i.e., tax and penalty-free), you must (1) have been contributing to the account for the previous 5 years and (2) be at least 59 ½ years old. However, if you must make an unqualified withdrawal from your Roth 401(k), 403(b), 457, TSP or Solo 401(k) (not recommended!), you only have to pay taxes and a 10% penalty on the portion of the withdrawal that represents earnings (except for certain circumstances discussed below). But this does not mean you can make an early withdrawal and designate the total amount as contributions as opposed to earnings. The IRS treats each withdrawal on a pro-rata basis, allocating taxes and penalties to each withdrawal based on the total percentage of earnings in the 401(k), 403(b), 457, TSP or Solo 401(k) account.

*For a 457 plan, the 10% penalty does not apply to distributions once you leave your employer sponsoring the plan (even if before age 59 ½), have an unforeseen emergency, take a qualified loan of $5,000 or less, or reach age 72 (age 70 ½ if born prior to July 1, 1949) while still employed.

To illustrate, say you have $100,000 in your Roth 401(k), of which $90,000 is from contributions and $10,000 is from earnings on those contributions. Any withdrawals will be considered to come 90% from contributions and 10% from earnings, meaning 90% would be nontaxable and the other 10% would be taxable and possibly subject to a 10% penalty. To illustrate further, assume you’re 45 years old and you make a withdrawal of $10,000 from your Roth 401(k). Of the distribution, $9,000 (10,000 x 90%) would be nontaxable and $1,000 would be taxable and potentially subject to a 10% penalty. If your tax rate is 24%, you would pay approximately $340 in unnecessary taxes and fees to make this early withdrawal. However, these taxes and fees would be significantly lower than those required for an early withdrawal from a traditional 401(k).

Note if you have a diversified (traditional and Roth) retirement plan account, you usually can choose the account from which you withdraw funds. This allows you to minimize your penalties/taxes depending on when you plan to make the withdrawals.

- Mandatory Withdrawals at 72: Similar to the traditional account, upon reaching age 72 (age 70 ½ if born prior to July 1, 1949), the IRS requires you to withdraw at least a minimum amount each year from your account. If you don’t take withdrawals, or you take less than required, you’ll owe a 50% penalty tax on the difference between the amount you withdrew and the amount you should have withdrawn (yikes, now go remind Grandma!)

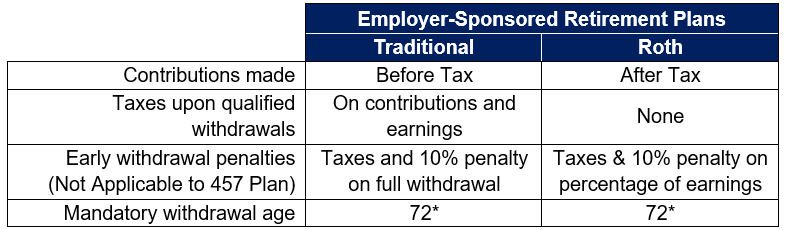

The following table provides a summary of the primary traditional vs Roth differences:

*Mandatory withdrawal age is 70 ½ if born prior to July 1, 1949 (changed by SECURE act beginning January 1, 2020).

Exclusions to Early Withdrawal Penalties (non-IRA)

The easiest way to avoid early withdrawal payments is to not tap your retirement account before age 59 ½. Yet s**t happens, and sometimes you don’t have any other choice than to withdraw the funds early. But good news! The IRS comes to the rescue when you’re going through hardship. The IRS will not charge you the 10% penalty on non-qualified withdrawals (i.e., those traditional plan withdrawals before age 59 ½ and Roth plan withdrawals before age 59 ½ or before you’ve been contributing to the account for the previous 5 years) from your 401(k), 403(b), TSP or Solo 401(k) under the following circumstances:

- Medical expenses (To pay for unreimbursed medical expenses in excess of 10% of Adjusted Gross Income (>7.5% if age 65 or older). We cover AGI in our post on taxes)

- Rollovers to an IRA or other qualified plan (To transfer balance to another qualified plan)

- Separation from company (When you retire, quit or get fired from your job during or after the year you reach age 55 [age 50 for public safety employees of certain plans]; if you do this, do not roll over your plan to an IRA or other qualified plan because this rule only applies to your current plan)

- Substantially equal periodic payments (You receive substantially equal periodic payments over your life expectancy; must be separated from employer)

- Military (You are a qualified military reservist called to active duty)

- IRS Levy (IRS takes money directly from your account to pay taxes owed)

- Court-ordered domestic payments (E.g., to pay spousal payments)

- Disability (Total and permanent disability of the participant or owner)

- Death (Of the participant or owner)

It’s important to distinguish between employer-sponsored retirement accounts and IRAs when it comes to withdrawal penalties: the IRS provides exceptions to the early withdrawal penalties for Education (qualified higher education expenses), First-Time Homebuyers (only up to $10,000) and Medical Insurance Premiums (only if unemployed) for IRA’s only; therefore, you will be penalized for unqualified withdrawals from your 401(k), 403(b), TSP or Solo 401(k) for these expenses.

Which One to Choose – Traditional or Roth?

There’s an ongoing debate and many example calculations about which is better: traditional or Roth. Most people will tell you a Roth retirement account is the better option, if available. But this is not necessarily true. Your choice should really depend on your circumstances and, specifically, how much higher (or lower) you think your tax rate will be during retirement.

Those in favor of the Roth account claim the small tax bill upfront—in exchange for what would otherwise be an undoubtedly larger tax bill later—provides more tax savings and prevents you the burden of and uncertainty in paying taxes at retirement. On the other hand, those in favor of the traditional account claim these plans allow you to invest more from pre-tax dollars which will experience compound growth and, in many cases, create a higher after-tax return than a Roth account. Decisively determining which plan is best for you requires a detailed calculation with many assumptions regarding your income and tax rate at retirement. I don’t know about you, but (a) I don’t have a clue what my retirement income will be and (b) I don’t really feel like paying a financial adviser to guess my future situation either.

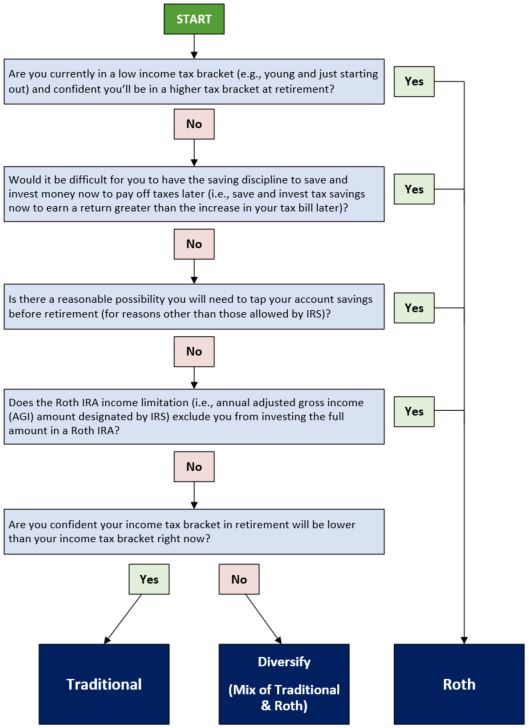

The diagram below simplifies the traditional vs Roth 401(k), 403(b), 457, TSP or Solo 401(k) decision for you (note there is a different decision tree for traditional vs Roth IRAs, which we cover in a separate post). This decision matrix is not perfect, but it will give you a good reference point on which you can base your decision.

As shown above, if you don’t confidently know whether your income tax rate will be higher or lower in retirement than it is today, it would be wise to hedge your bets and split your contributions between a traditional and Roth 401(k), 403(b), 457, TSP or Solo 401(k). Keep in mind, however, you’ll still be capped at $19,500 (or $26,000 if you’re age 50+) for your total annual contributions (e.g., $9,750 to traditional and $9,750 to Roth).

For more information on a specific employer-sponsored retirement plan, click on the associated link below:

If you have any questions or words of wisdom, please leave a comment!

Really helpful flowchart. Clearest path to choosing that I have seen. Should be a first hit on Google

Thanks, Cathy! Glad it helped

Is it too late to switch to a Roth if you started with traditional?

Nope! You can simply start contributing to a Roth (you will have both a traditional and a Roth account), or you can perform what’s called a “conversion” from your traditional account to a Roth (you will owe taxes on the amount). Be careful with any conversions as you don’t want to accidentally get hit with early-withdrawal penalties.

Thank you

Thanks for the post! Passed it along again!

Thanks again, Alec!

I don’t comment often, but this is the best info I’ve found on traditional vs roth. The decision tree in particular

Thanks, Danny! Appreciate the feedback!

Man. Making my traditional decision look bad

Haha traditional is not bad at all. Roth is not available or even appropriate for everyone, but it’s still worth considering. Any contribution to a traditional or Roth retirement account is still a good decision.

So helpful! Now I just hope Trump keeps the Roth.

Me too, Sarah. Thanks for the comment!

Where does my traditional 401(k) contribution amount show up on my W-2? Is this a deduction?

Box 1 on your W-2 includes only your taxable earnings. Thus, for a traditional 401(k), the amount in Box 1 excludes your 401(k) contributions (as they are pre-tax). You should, however, see the amount in Box 12 with the letter “D.” While your contributions are not “deductions” on your tax return, they are excluded from your income up front. Refer to the upcoming post on taxes for more information!

Thanks

I think people take the Roth for granted. Most likely a mix of ignorance and laziness

I give people the benefit of the doubt that it’s not laziness. Maybe ignorance, maybe Roth is not an option, or maybe it’s just not the right option. Part of the reason I made this post!

Sent this to my kids!!

Thanks again, Crystal

This is excellent, Adam. Very well written.

Thank you! Appreciate the kind feedback

Now I know! ty

Thanks for reading!

Traditional makes my 401(k) balance look bigger, so I like that one

Haha. I’m sure you’re well aware that’s misleading. It’s a common mistake for people to forget future taxes make up a chunk of their current traditional 401(k) balances, so don’t fall into that group

Great. I’m interested in the differences for IRAs too

Thanks, Gene. A post on IRAs is coming soon to a theater near you. Not really – just this blog. It is coming soon

Simple and easy to understand

Thanks, Katharine. That’s the goal!

Really good post. Just subscribed.

Thanks, Taryn. Hope you enjoy!

Lol I like the Grandma and Grandpa reminders. Those are hefty penalties

No kidding. Thanks for the comment!

You should have more blogs. Made this decision much easier!

Thanks, Lacey! More posts to come – feel free to subscribe

Recommendation to others: don’t use a financial advisor. This is a better explanation than I got.

Is this site credible?

I’m a little biased as I’m the author, but yes this site is credible. In fact, I encourage you to fact check me on anything. I’m always open to improvements.

OK OK I believe you!

Exactly the information I needed. Please post more

Thanks, A.J. – glad it helped. Feel free to subscribe as more posts are coming