Traditional vs Roth: a heavyweight battle the likes of Ali vs Frazier, Marvel vs DC and the chicken vs the egg. This post makes the traditional vs Roth decision for IRA plans as easy as possible (Note there’s a separate post for making this decision for employer-sponsored retirement plans).

Before investing in an IRA, you need to decide which type of IRA you’ll invest in: traditional or Roth. Whereas the traditional vs Roth decision for an employer-sponsored retirement plan can come down to more obscure guesswork ¯\_(ツ)_/¯, for most of you the Roth is the better option when it comes to an IRA. Why? Let’s get to it.

Similar to the rules for employer-sponsored retirement accounts, the difference between “traditional” and “Roth” plans is purely a difference in timing of when you pay state and federal income taxes (as well as certain rules and limitations related to withdrawals).

When you fill out your tax return each year, you start with your earned income before reducing it by certain amounts to calculate your “taxable income.” You then multiply your taxable income by the applicable tax rates to calculate your taxes owed. Thus, the more you can lower your taxable income, the smaller the amount you’ll pay the federal, state or even local government in taxes. If you contribute to your IRA, whether those funds reduce your taxable income this year or reduce your tax bill when you eventually withdraw the funds in retirement depends on whether your IRA is traditional or Roth.

Let’s take a look at the specifics of each, starting with traditional:

Traditional IRA

- Taxes Deferred: For a traditional IRA, you get to contribute to your IRA using “pre-tax” income. In other words, you get to deduct any contribution amount to your IRA from your taxable income for the tax year.

- Taxes upon Withdrawal: Once deposited into your IRA, your investments and their earnings (reinvested) grow tax-free until withdrawal. While you haven’t yet paid taxes on these amounts, having pre-tax investments early allows the larger amounts to compound over a long period of time. Upon withdrawal of funds from your account, you pay income taxes on the full withdrawal (i.e., both your contributions and earnings).

- No Access before 59 ½: For all contributions and earnings in a traditional account, you cannot access the funds before age 59 ½ without paying taxes and a penalty (except for certain circumstances discussed in the post on IRA basics). If you withdraw funds from your account prior to this date, you will pay income taxes on the full amount withdrawn as well as a 10% penalty (yikes!).

- Mandatory Withdrawals at 72: Upon reaching age 72 (age 70 ½ if born prior to July 1, 1949), the government comes a calling. This is when the IRS requires you to withdraw at least a minimum amount each year from your account and pay ordinary income taxes on the withdrawal. If you don’t take withdrawals, or you take less than required, you’ll owe a 50% penalty tax on the difference between the amount you withdrew and the amount you should have withdrawn (this could be a lot of mullah!).

Roth IRA

- After-Tax Contributions: For a Roth IRA, you contribute to your IRA using “after-tax” income. Therefore, when you file your taxes for the year, the amount contributed to your IRA will remain in your total taxable income.

- Tax-Free upon Withdrawal: Once deposited into your IRA, your investments and their earnings (reinvested) grow tax-free. You then pay no, zilch, nada taxes on the contributions and their earnings upon withdrawal (now that’s a deal!).

- Flexible Access before 59 ½: In order for a withdrawal from a Roth IRA to be qualified (i.e., tax and penalty-free), you must (1) have been contributing to the account for the previous 5 years and (2) be at least 59 ½ years old. However, if you must make an unqualified withdrawal from your Roth IRA (not recommended!), meaning you make a withdrawal before the 5-year period or you have not yet reached the age of 59 ½, you only have to pay taxes and a penalty on the portion of the withdrawal that represents earnings (except for certain circumstances discussed in the post on IRA basics). What makes this rule beneficial, and distinct from nonqualified distributions from Roth employer-sponsored accounts, is that Roth IRAs have distribution ordering rules that benefit you! As discussed in the post for employer-sponsored retirement plans, the IRS treats nonqualified withdrawals from Roth employer-sponsored accounts on a pro-rata basis, allocating taxes and penalties to each withdrawal based on the total percentage of earnings in the account. On the other hand, the IRS treats withdrawals from a Roth IRA in the following order:

- Regular contributions (always tax and penalty free since you already paid taxes upon contribution)

- Conversion contributions (if you converted a traditional IRA to a Roth IRA)

- Earnings on contributions

Based on this order, you can tap your Roth IRA at any time up to the amount of your contributions without paying any taxes or penalties (until your withdrawals surpass your contributions and hit earnings). However, this is still not recommended as you don’t want to tap your retirement savings and IRAs provide you terrific tax benefits!

In case you didn’t follow that, let’s look at an example. Say you have $100,000 in your Roth IRA, of which $90,000 is from contributions and $10,000 is from earnings on those contributions. Also assume you’re 45 years old and you make a withdrawal of $95,000 from your Roth 401(k). Of the distribution, the first $90,000 would be nontaxable and penalty-free, and $5,000 would be taxable and potentially subject to a 10% penalty. If your tax rate is 24%, you would pay approximately $1,700 in taxes and fees to make this early withdrawal. However, these taxes and fees would be lower than those required for an early withdrawal from a traditional IRA.

Note if you invest in both a traditional and Roth IRA, you can choose the account from which you withdraw funds. This allows you to minimize your penalties/taxes depending on when you plan to make the withdrawals.

- No Mandatory Withdrawals at 72: This is a huge advantage of Roth IRAs—no required minimum distributions! If you have a Roth IRA, the IRS never requires you to make withdrawals at any age; thus, when you die, you can pass along any Roth IRA savings to your kiddos or whomever else tax-free. Yes, that makes Roth IRAs unique from almost all employer-sponsored retirement plans, whether Roth or traditional, and the traditional IRA. Remember this!

Roth IRA Contribution Phase-Out

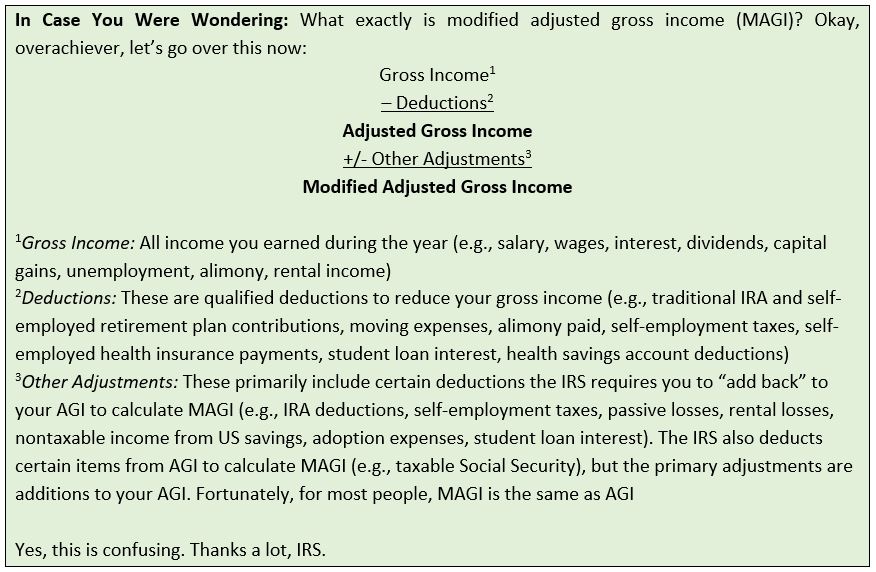

There’s one caveat to the Roth IRA which is important to know: there’s an income limitation. More accurately, this income limitation is actually a modified adjusted gross income limitation. WTF is that? This is a tax term (ahhhhhh run for the hills!). We cover adjusted gross income in our separate post on taxes. For now, all you need to know is that modified adjusted gross income (MAGI), for most people, represents your total income less certain tax deductions (e.g., traditional IRA contributions, self-employed retirement plan contributions, student loan interest).

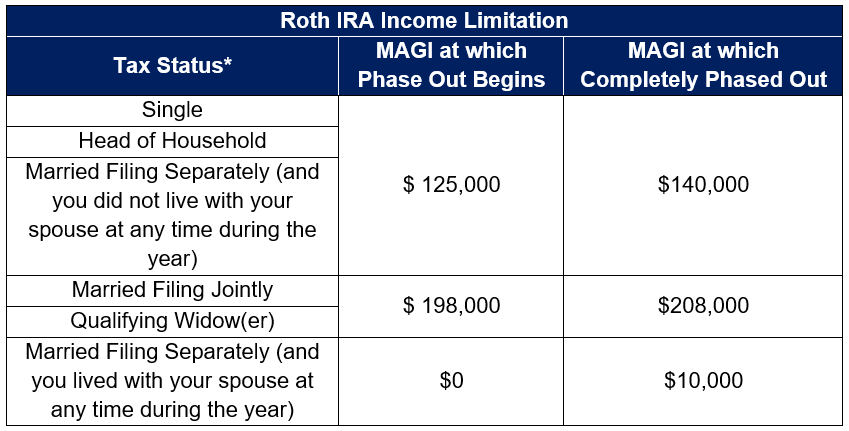

You can only contribute to a Roth IRA if your MAGI is below a certain threshold set by the IRS each year. In 2021, the IRS MAGI limitations are as follows:

*We cover these tax statuses in our separate post on taxes.

*We cover these tax statuses in our separate post on taxes.

Based on the chart above, the IRS begins to reduce the limit you can contribute to a Roth IRA ($6,000 or $7,000 depending on your age) if you’re single and make over $125,000 or married and together make over $198,000. If you’re single and make over $140,000 or married and together make over $208,000, you cannot contribute to a Roth IRA (sorry, although I’m sure you’ll be just fine with that income).

Clearly, based on these limitations, the IRS knows how unique and valuable Roth IRAs are, and so should you.

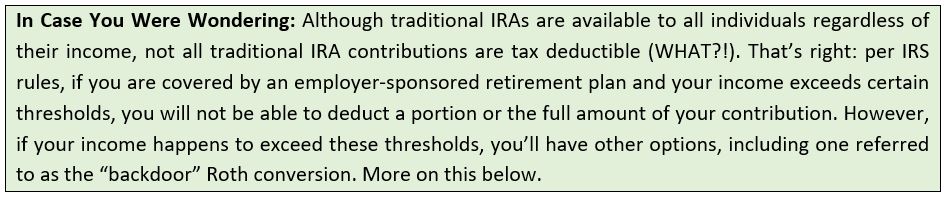

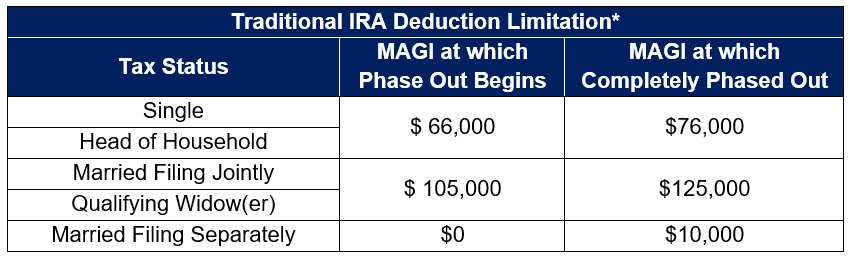

Traditional IRA Deduction Phase-Out

Here’s another landmine for rich people. This might be surprising, but there are actually income limitations on the tax deductibility of traditional IRAs. Yes, traditional IRAs are available to all individuals regardless of their income, but one of the main benefits of a traditional IRA is its immediate tax deductibility (i.e., you don’t pay taxes on your contribution): not so for people with certain income. In accordance with IRS rules, if you are covered by an employer retirement plan AND your MAGI (see definition above) exceeds certain levels, you will not be able to deduct the full amount of your traditional IRA contribution. In 2021, the IRS MAGI limitations are as follows:

*Traditional IRAs have no income limitation for contributions and are thus available to all individuals. This table applies only to the tax deduction of traditional IRA contributions if you are also covered by an employer retirement plan.

Based on the chart above, if you’re single, have MAGI of $80,000 and contributed to a traditional IRA, none of your contribution will be tax deductible (i.e., you will contribute with after-tax dollars). In this scenario, this person should have absolutely contributed to a Roth IRA, possibly providing a partial explanation for why this person is still single (just kidding). You may wonder, what’s the point of a nondeductible traditional IRA? This situation certainly eliminates one of the key benefits (after-tax contributions), but you still get the tax-deferral on all earnings and reinvestments. There’s still value in a traditional IRA even without the deductible contribution, and I’m not going to throw you a pity party for having too much income.

Summary

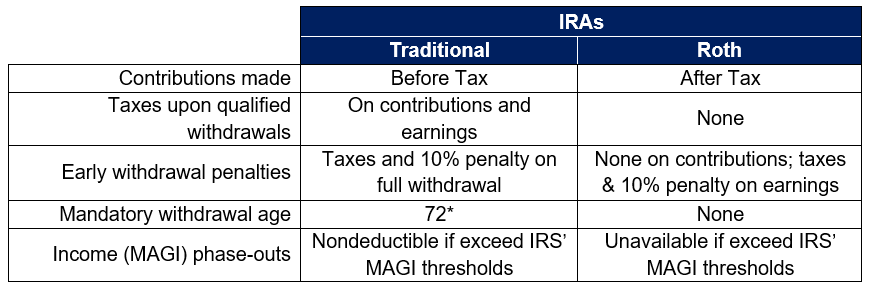

The following table provides a summary of the primary traditional vs Roth IRA differences:

*Mandatory withdrawal age is 70 ½ if born prior to July 1, 1949 (changed by SECURE act beginning January 1, 2020).

Backdoor Roth IRA

So you’ve done well for yourself and exceed the Roth IRA income limitation. Congratulations. This in effect means you also exceed the traditional IRA income limitation for tax deductibility (that is, if you’re covered under an employer retirement plan). Congratulations again. Now what?

This is when you should take advantage of a completely legal transaction called a backdoor Roth IRA conversion. A backdoor Roth conversion allows you to sidestep the IRS Roth IRA income limitation by contributing to a traditional IRA and then converting the traditional IRA into a Roth IRA. Why do this? Think about it: while your contribution will be after-tax for both the nondeductible traditional IRA and backdoor Roth IRA, your earnings on those contributions to a backdoor Roth account will grow tax free (i.e., you pay no taxes on these earnings at withdrawal). On the other hand, when it comes time to make withdrawals from a nondeductible traditional IRA account, you would pay taxes on those earnings. Backdoor Roth is a no-brainer!!

Anyone can make this conversion, and, funny enough, there is no limit on the amount you can convert from your traditional IRA (although you’re still limited to the annual contribution limits to the traditional IRA). For those of you thinking you’ll get away with paying zero taxes on the conversion, think again. If your traditional IRA contributions were tax deductible (i.e., before-tax dollars), you will be taxed on the money you convert from your traditional IRA to your Roth IRA as income. Thus, make sure you have the cash to pay taxes on this conversion before deciding to do so.

In order to convert your traditional IRA via the backdoor Roth conversion, you first need to contribute to a traditional IRA or have an existing traditional IRA balance. You should then have the option to convert the traditional IRA account (or a portion of the account) to a Roth IRA account on your brokerage’s website or via a phone call to the brokerage itself. They’ll remind you that you owe taxes on the conversion (unless you contributed to a nondeductible traditional IRA with after-tax dollars), so make sure you keep records of the conversion and taxes you owe (if any) so you can remember come tax-filing time.

To ease your tax filing process, it’s best to make the traditional IRA contribution and associated backdoor Roth IRA conversion in the same year. Why? When filing your taxes, you include your contribution on the tax return year for which that contribution was made. For your backdoor Roth conversion, you include the conversion on the tax return year in which that contribution was made. For example, if you make a traditional IRA contribution for tax year 2021 on September 30, 2021 and convert the contribution to a Roth IRA using a backdoor conversion on January 10, 2022, you will report the traditional IRA contribution on your 2021 return and the backdoor Roth conversion on your 2022 return. If you think this is both annoying and confusing, I agree.

Which One to Choose – Traditional or Roth?

If you referenced the decision making process for traditional vs Roth for employer-sponsored retirement plans in the separate post, throw that out the window for the next few minutes: your choice may be completely different for an IRA.

Just as with traditional vs Roth for employer-sponsored retirement plans, part of your decision depends on how much higher (or lower) you think your tax rate will be during retirement. On one hand, a Roth IRA can provide you more tax savings (by paying a smaller tax bill upfront) and prevent you the burden of and uncertainty in paying taxes at retirement. On the other hand, a traditional IRA can allow you to invest more from pre-tax dollars which can experience compound growth and create a higher after-tax return than a Roth account. Decisively determining which plan is financially best for you based on expected tax rates requires a detailed calculation with many assumptions regarding your income and tax rate at retirement. As mentioned earlier, I don’t know about you, but (a) I don’t have a clue what my income will be at retirement and (b) I don’t really feel like paying a financial adviser to guess my future situation either.

However, whereas the traditional vs Roth choice for employer-sponsored retirement plans is more of a toss-up, the unique benefits of a Roth IRA should likely push you in favor of a Roth IRA over a traditional IRA. The Roth IRA, if available to you based on the income limitation, provides (1) easier and cheaper access to your funds in case you need to access them before age 59 ½ and (2) no required minimum distributions at any age. In addition, you should consider that sometimes employer-sponsored retirement plans may not offer a Roth option; if this is your case, you should jump at the opportunity to invest in a Roth IRA to provide diversification to your retirement portfolio.

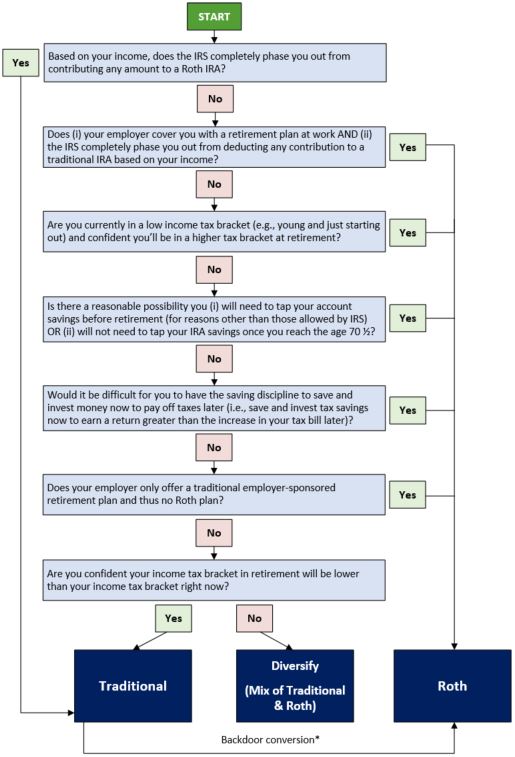

The diagram below simplifies the traditional vs Roth IRA decision for you (note this decision tree is distinct from that of the employer-sponsored retirement plan, so consider each decision separately). In addition, remember that Roth is not an option for the SEP IRA or SIMPLE IRA (more on these self-employment plans in another post), so this only applies to an IRA. This decision matrix is not perfect, but it will give you a good reference point on which you can base your decision.

*If you are covered by an employer retirement plan and contribute to a nondeductible traditional IRA (see section above on the traditional IRA deduction phase-out), you should strongly consider converting your traditional IRA to a Roth IRA via a backdoor Roth conversion. Refer to the section above on the backdoor Roth IRA conversion for more information.

*If you are covered by an employer retirement plan and contribute to a nondeductible traditional IRA (see section above on the traditional IRA deduction phase-out), you should strongly consider converting your traditional IRA to a Roth IRA via a backdoor Roth conversion. Refer to the section above on the backdoor Roth IRA conversion for more information.

As shown above, there are certain advantages to a Roth IRA that will likely push you in that direction. However, if the unique benefits don’t sell you and you don’t confidently know whether your income tax rate will be higher or lower in retirement than it is today, you can hedge your bets and split your contributions between a traditional and Roth IRA. Remember, however, you’ll still be capped at $6,000 (or $7,000 if you’re age 50+) for your total annual contributions (e.g., $3,000 to traditional and $3,000 to Roth).

Happy investing, and leave a comment for any questions!

Very well written again, Adam.

Thank you!

still like traditional

Thanks for the comment, Beau. If you don’t mind, please let me know what is pushing you towards traditional

That flowchart is extremely helpful

Thanks, Laura. Glad you like it!

Thank you for posting this. Helpful to see the differences between this an 401k decision. Roth seems like the clear winner here.

Absolutely. Glad it helped!

like the decision tree

Glad it helps!

While I diversify my 401k between both, I go with a Roth IRA for the reasons you mention.

Thanks for the comment and reading

I’ve directed a few people to your decision tree. Really good

Thanks for passing along! Glad you like it

excellent

Thanks again, Paul

Roth it is

Thanks for reading!

A downside of the backdoor is taxes and keeping track of it. But I agree it’s worth it

It can get tricky, but yes I still think it’s worth it. Thanks for the comment!