Did Michael Jordan wear sandals to play his way to six championships? Did George Washington fight his battles with a balloon animal? Did Amelia Earhart hang on to a pelican to cross the Atlantic? No! They chose the best tools at their disposal to reach their goals, and you should do the same to reach financial security. Okay, maybe those are stretch comparisons, but selecting the best checking and/or savings account(s) is an important decision you should knock out or fix as soon as possible. This post covers the specific steps to complete and strategies to consider when opening or closing a bank account.

Bank Accounts

If you’ve read the previous blogs, you know how you save (don’t spend money you don’t have) and why you should save ASAP (time value of money and compound growth), but where do you put your cash and savings?

As a reminder from a previous post, First Things First: Your Financial Priorities, your financial priorities should be as follows:

- Establish fund for immediate obligations (e.g., rent, food, minimum debt payments)

- Establish emergency fund (3–6 months of living expenses)

- Contribute to employer retirement plan to maximize employer match

- Pay off all high-interest-rate (7% +) debt, working down from highest-interest debt first

- Invest maximum amounts in tax-advantaged accounts (e.g., 401(k) and IRA)

- Pay off all remaining debt (i.e., low-interest-rate debt)

- Invest in non-tax-advantaged accounts

You should store your immediate obligation fund and emergency fund in a safe, physical location or non-risky, liquid accounts. Liquid in this sense does not mean you should store your cash underwater; liquid in the financial sense means the asset/account can be quickly converted into cash, with minimal impact to the price received in the open market. For example, you should not consider your car your emergency fund as it is challenging to sell your car immediately unless you significantly drop the price and sell it to your next-door neighbor.

Immediate Obligation Fund Accounts

The purpose of your immediate obligation fund is to pay for ongoing, everyday expenses, such as food, rent, utilities, clothes, etc. As you will pay for these various items on a day-to-day or month-to-month basis, you need regular access to cash for these payments. You have the following primary options for your immediate obligation fund (Note the recommended amounts assume an immediate obligation fund of $1,000 for example purposes):

- Wallet/Purse ($50): You should not keep your entire immediate obligation fund in your wallet or purse. Just like you want to diversify your risk in investing, you want to avoid losing your entire immediate obligation fund in case your wallet or purse gets lost or stolen. While fewer and fewer transactions require the payment of tangible cash, it makes sense to keep a small amount of cash on you for the purposes of cash-only transactions (e.g., tips, parking, cash-only restaurants)

- Checking Account ($950): A checking account keeps your cash secure while offering you easy access to your money to make daily purchases and transactions. True to their name, checking accounts come with checks, but you’ll likely use your debit card, ATM card or online banking applications more often for your daily transactional needs. Checking accounts generally provide you very low interest rates on your deposits, so you want to maintain a balance in your checking account with just enough money to cover your immediate obligation fund needs. If you have extra funds in your checking account beyond what is needed for your immediate obligation fund, transfer the excess cash to savings accounts or investments to earn a higher rate of return. Refer below for more information on checking accounts and how to open an account.

Emergency Fund Accounts

Whereas your immediate obligation fund is meant to pay for expected, everyday expenses, the intent of your emergency fund is to pay for unexpected expenses. Therefore, while you need your emergency fund to be liquid, you don’t require regular access to the cash on a day-to-day basis. You have several different options for your emergency fund (Note the recommended amounts assume a full emergency fund of $5,000 for example purposes):

- Savings Account ($5,000): A savings account keeps your cash secure while allowing you to accumulate interest on funds you’ve saved for future needs. Savings accounts generally provide higher interest rates than checking accounts, so these accounts are perfect for earning more interest on cash you plan to store for an unknown, extended period of time.

Before considering other savings account options, it’s important to distinguish between checking accounts and savings accounts as these will likely be the first two accounts you open. Note you can open a checking or savings account at a bank or credit union; however, for the purposes of this blog, we will use the term “bank” to encompass credit unions as well.

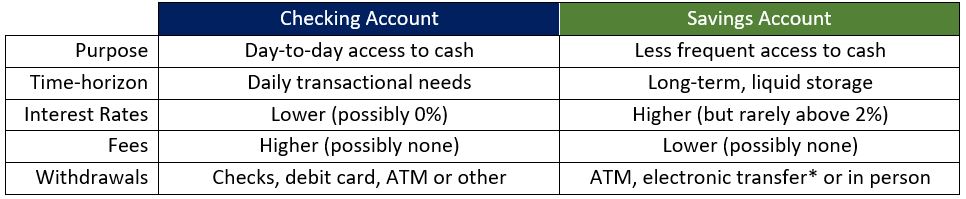

Checking and savings accounts, which are the most common financial products offered by banks, provide security for your cash by allowing you to deposit funds which will be insured by the US government (currently up to $250,000). However, as the following table displays, the two accounts differ in their intended use and time-horizon for withdrawal:

*Savings account pre-authorized or automatic withdrawals are limited to six per month in accordance with a federal law known as “Regulation D”

*Savings account pre-authorized or automatic withdrawals are limited to six per month in accordance with a federal law known as “Regulation D”

As shown above, checking accounts and savings accounts each have their advantages and disadvantages. For this reason, many people open both a checking and a savings account to optimize the features of each account (as discussed below, you will want to open a savings account with an online bank). For instance, if you have extra cash not regularly needed that is sitting in your checking account, you can transfer the extra cash to your savings account in order to take advantage of the higher interest rates. However, you want to be careful not to overdraw funds from your checking account (e.g., when you write a check for an amount higher than the balance in your checking account) as this will result in overdraft fees.

Opening a new checking or savings account is fairly quick and simple if you know how to prepare and what to expect. In some cases, you can set up an account without leaving the comfort of your own home! Here are the general steps to set up a checking account and what you need to know:

1 Research and select bank account(s):

Bank accounts all have different fees and interest rates. Some banks have no brick and mortar stores (e.g., online banks); some only have a few, local locations; and some have thousands of locations across the globe. Some have minimum deposits, and some are known for having the best customer service. In general, you want to select the bank checking/savings account with the lowest fees, highest interest rates and services/locations most in-line with your preferences. Spend the time to research the bank accounts that work best for you based on the relevant terms, reviews and ratings. Be sure to read the fine print, and don’t open an account at a bank solely based on its name.

As we live in a digital age, more and more people are turning to online banks for their savings and checking accounts. Online banks, such as Ally Bank, Fidelity, Schwab and several others, have the benefit of a lack of infrastructure and low overhead costs (i.e., non-direct labor and material costs, such as administrative or utility costs). Accordingly, online banks often offer much higher interest rates than those offered by traditional banks. For example, most traditional banks often offer checking account interest rates of 0.01%, whereas online banks usually offer checking account interest rates from 0.02% to 0.80%. Online banks also generally provide fewer and lower fees, various personal finance tools, high convenience and 24/7 customer service. For most online banks, you can use almost any bank branch’s ATM and get reimbursed for any associated fees (saving you from the headache of wandering around looking for your bank’s ATM!).

Before deciding to set up an account with an online bank, consider the consequences of no or very limited use of an onsite, in-person bank. You will not have a personal, in-person relationship with the bank teller every time you make a bank transaction or need to fix an issue. While you will be able to deposit checks using the camera on your phone, you will have limited opportunities to deposit cash. Finally, consider there will be certain situations when an in-person bank would provide more convenience (e.g., obtaining foreign currency before an international trip and resolving an issue on a check deposit, notarizing a document).

Considering these drawbacks, it would be wise to open an online savings account AND a traditional checking account. When identifying your traditional checking account, select one with no (or very low) fees and no (or a small) minimum balance. The balance in your checking account should include only the funds you will need for daily transaction needs. Keep the remaining balance, including your emergency fund, in your online savings account to take advantage of the higher interest rates. Thus, the traditional checking account will provide you in-person bank service opportunities while the online account will then provide you the opportunity to earn high interest with low fees on the majority of your savings.

2 Open and fund the accounts:

Once you’ve chosen a checking and/or savings account with low fees and high rates, your next step depends on whether you have an existing account at another bank. If you already have an account at another bank, you can create your new account and transfer money from the existing account either on the new bank’s website or over the phone. If you do not already have an account at another bank, you will need to call the bank or visit the bank in person to open an account and fund it with cash or a check.

3 Provide the bank the required information

When you open your bank account, regardless of the method, you will generally be asked to provide the following:

- Identification: Valid, government-issued photo ID, such as a driver’s license or passport

- Personal Information: Date of birth, Social Security number, phone number and email address

- Money: Cash, check, money order or electronic transfer from existing account

- Parent (if younger than 18): Parent or legal guardian as co-owner to sign legal documents with bank

- Other Applicants (if joint account): All joint owners will need to provide required information

4 Close old accounts (and update any previous links to old bank account)

Be sure to close any old, undesired accounts in order to avoid any fees with the old bank. To do so, contact your old bank and withdraw all funds and items physically stored in any safe-deposit boxes. Then obtain a written statement from the bank confirming your account is closed. Also ask a representative at your old bank about its account-reopening policies as some banks may reactivate your closed account to receive automatic deposits, putting you back on the hook for any associated fees from the bank. Upon confirming your bank account is closed, shred all checks from your old bank account.

You then want to update any deposit or payment connections from your old account to your new account. For instance, provide your employer your new bank account information for direct deposit, update any automatic bill payments to third parties (e.g., utility or rent payments), update any linked accounts (e.g., Venmo or PayPal) and update your Smartphone apps.

5 Understand your new account’s fees and terms

The last step is to monitor your new bank account and research how you can avoid fees, such as monthly service, overdraft, minimum balance and wire transfer fees. The most common fee banks charge for checking and savings accounts is the monthly service charge, which the bank can generally waive if you meet a minimum daily balance or if you sign up for direct deposit.

- Other Savings Accounts: While we put the full $5,000 emergency fund into a savings account for example purposes, you can also mix and match this amount using the following secure, liquid, savings accounts:

Certificate of Deposit (CD): You’ve probably heard the financial term “CD” before, but what does it mean? Spoiler alert: this has nothing to do with the now obsolete music compact disc. A certificate of deposit (CD) is a deposit you can make with your financial institution for a set interest rate and a pre-set period of time. The key to CDs is a “pre-set period of time,” meaning you cannot withdraw from this deposit for a certain time period, ranging from a few months to several years, without facing early withdrawal penalties. Because of these potential early-withdrawal penalties, CDs usually provide a higher interest rate than traditional savings accounts. Invest in CDs only if you are confident you will not need the deposit for the established period of time.

Money Market Account: Money market accounts are very similar to savings accounts, but they require you to maintain a higher balance to avoid a monthly fee and oftentimes provide you with limited check-writing ability. Interest rates for money market accounts, which vary based on money markets, are generally higher than those for savings accounts and become more favorable the higher the balance you invest. Invest in money market accounts only if your deposited balance is high enough to provide you more favorable interest rates than the rate of your savings account.

Congratulations! You’re now an expert on where to store your immediate obligation and emergency funds. Subsequent posts focus on where to store your money beyond these amounts and how to invest to earn even higher returns.

I like the simplicity and the dollar amounts you put towards it

Thanks for the comment, Jamaal. Appreciate the feedback!

Have to learn to walk before you run!!!

Exactly right! Thanks again, Nancy

Another good one for my class! Although $5,000 is stretching it…

Thanks, Alec. Please continue to pass along! And you can change the amounts to whatever is applicable for the audience

I use Ally for savings and like it a lot. I also just got an email this week that their interest rate went up to 1.45%. Which bank do you use?

Thanks for the comment, Caroline. Ally is great, and actually the online bank I use! My recommendations vary based on your minimum balance (which determines whether any monthly maintenance fee will be waived) as well as if a sign-up bonus applies, but in general I recommend the following:

– Online checking account: Ally (low fees & high interest rates)

– Checking accounts w/ physical service locations: Chase (great sign-up bonus), Bank of America (great service options) or Capital One (hybrid online bank with physical locations)

– Savings account: Ally (high interest rate, no minimum balance, low fees & a free checking account!)

Which checking accounts do you recommend?

Thanks for the comment, Genny. I’ll reiterate what I mentioned to Caroline above: my recommendations vary based on your minimum balance (which determines whether any monthly maintenance fee will be waived) as well as if a sign-up bonus applies, but in general I recommend the following:

– Online checking account: Ally (low fees & high interest rates)

– Checking accounts w/ physical service locations: Chase (great sign-up bonus), Bank of America (great service options) or Capital One (hybrid online bank with physical locations)

Thanks! That’s helpful.

The Bulls now play like they’re wearing sandals

If that’s the case, then I think my Hawks are playing with flippers 🙂

I get by without a savings account. I find investments in brokerage accounts are usually liquid enough for me. Thoughts?

Nicolas – you’ll need to consider both risk and accessibility. First, if you’re investing, you face a higher risk of losing some or a large portion of your savings. Second, while it may seem like you can withdraw funds from your brokerage account quickly, it can take several days to do so. When you have an emergency, you may not have the luxury of waiting this long.

Because the money you put in a savings account should be your safety net for emergencies, I think it’s important to secure this balance and have 24/7 access to it. I recommend that you determine the amount of savings you need for emergencies and then lock it in by leaving it in a savings account. You can then invest all extra funds above this amount.

Good read for beginners and those of us without much to invest

Thanks, Felipe. Best of luck saving and investing

Bank account variations don’t make much of a difference. Better to spend your energy elsewhere

Thanks for the comment, Jamie. In the grand scheme of things, will the excess interest received on my checking and savings account balances knock my socks off? No. But if you’re in the process of opening a bank account, or if you’re willing to switch bank accounts, it’s best to set yourself up with the best bank account as early as possible. This gets back to the argument of time: if you’re paying fees or missing out on higher potential interest rates, those amounts will only compound over time, which eventually will make a large difference.

I like the checking account and savings account comparison box. I’ve been looking for something like that

Thanks, Xi. Appreciate the support!

This is too basic for me, but I could see how this is helpful for beginners. Please get more advanced

Thanks for the comment, Gene. Hang in there: more advanced material is coming soon. Have to start with the basics!

Great!

Helpful!

Thanks, Katharine. You’re welcome to subscribe!

I don’t see a need for a savings account. I recommend just putting money into a brokerage account instead

Thanks for the comment, Owen. Similar to my note to Nicolas, above, you need to consider both risk and accessibility. First, if you’re investing, you face a higher risk of losing some or a large portion of your savings. Second, while it may seem like you can withdraw funds from your brokerage account quickly, it can take several days to do so. When you have an emergency, you may not have the luxury of waiting this long.

Because the money you put in a savings account should be your safety net for emergencies, I think it’s important to secure this balance and have 24/7 access to it. I recommend that you determine the amount of savings you need for emergencies and then lock it in by leaving it in a savings account. You can then invest all extra funds above this amount.

That makes sense. I guess its important to nail down that savings amount, which I doubt most people do. Well written article!

Thanks for reading!