Here in the great US of A, an Individual Retirement Account (IRA) is as American as hot dogs, bourbon and Abe Lincoln’s beard. Yet according to TIAA, fewer than one third of Americans have opened an IRA, and less than one fifth actually contribute to one (insert face palm). An IRA has great perks: this is what you need to know to take advantage of them.

IRA Background

An IRA is a tax-advantaged retirement account available to all individuals who have earned income during the year. Although the contribution limits for IRAs are much lower than those for most employer-sponsored retirement plans, those who don’t have access to an employer plan, such as a 401(k), can still contribute to an IRA.

Before getting into IRA specifics, let’s take a step back to remember where an IRA falls in your financial priorities. As detailed in the post on Your 7 Financial Priorities, investing in tax-advantaged retirement accounts should be your first priority after you’ve established your immediate obligation fund (Priority 1) and emergency fund (Priority 2), maximized your employer match (Priority 3) and paid off all high-interest-rate debt (Priority 4). These tax-advantaged retirement accounts include the following two separate groups of accounts:

We cover the left side of this table—employer-sponsored retirement accounts—in other posts. This post details the right side of the table—IRAs. Remember, you want to invest in BOTH employer-sponsored retirement accounts and individual retirement accounts (IRAs), if eligible.

As long as you earned income from working in the current calendar year, you are eligible to participate in an IRA (meaning you or someone else can contribute to your IRA). While the IRS imposes maximum contribution limits to IRAs, you (or someone else on your behalf) can only contribute the amount you earned in income during the year. Eligible income sources include wages, salaries, bonuses, commissions, tips, professional fees and earnings from self-employment. However, interest, dividend, pension, rental or annuity income do not qualify you to make an IRA contribution. Based on this criteria, you can open an IRA in a child’s name as soon as they get their first part- or full-time job.

For example, Henry, an unmarried college student working part-time in the campus dining hall, earns $2,500 in 2021. Henry can contribute $2,500, the amount of his compensation, to his IRA for 2021. Henry’s grandmother can make the contribution on his behalf.

IRA Contribution Limits

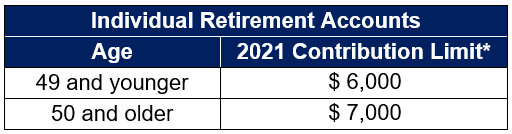

Each year, the IRS imposes contribution limits for IRAs. The IRS contribution limits for 2021 are as follows:

*This amount cannot exceed your taxable compensation for the year.

*This amount cannot exceed your taxable compensation for the year.

The contribution limits above apply on a total IRA basis (i.e., if you contribute to both a traditional and Roth IRA [we will discuss these below], your total contribution between the two IRAs cannot exceed the limits above).

The IRS allows you to contribute to your IRA for a particular tax year up until mid-April (i.e., tax day—typically April 15th) of the following year. This means you have a total of 15 ½ months to contribute to your IRA each year. For instance, you have until April 15, 2022 to contribute to your IRA for the 2021 calendar year. You can make your annual IRA contribution as a lump-sum payment or a series of payments. For example, if you want to invest the maximum amount to your IRA for 2021, you can either make a lump-sum contribution of $6,000 ($7,000 if you’re age 50 or older) sometime between January 1, 2021 and April 15, 2022 or you can invest $387 per month to contribute the full $6,000. Whereas employers deduct a percentage of your pay to contribute to an employer-sponsored retirement account, for an IRA, you simply transfer funds to the designated account with a financial institution.

As an additional IRA benefit, the IRS allows a spouse with no taxable income to contribute to his or her own IRA based on the income of his or her spouse.

For example, Jack, age 52, is married with no taxable compensation for the current year. He and his wife, Jill, reported taxable compensation of $70,000 on their joint return. Jack and Jill may each contribute $7,000 ($6,000 plus an additional $1,000 contribution for being age 50+) to their separate IRAs (total contribution of $14,000).

You may be asking, where in the world am I supposed to find an extra $6,000 after paying all of my bills? Good question, but remember this is Priority 5. After checking off Priorities 1 through 4, any leftover money, be it $1 or $10,000, should be diverted to your tax-advantaged retirement accounts (i.e., either your employer-sponsored plan or IRA: more on which one you should choose below). It may not seem like much, but due to the tax savings of IRAs as well as our best friend compound interest, even a small amount can go a very long way.

To illustrate, assume Anna is in the 24% tax bracket and has $1,000 in additional savings after taking care of Priorities 1 through 4 for the year. Instead of buying a dress and shoes she’ll wear twice in her life, she invests the $1,000 in a traditional IRA (see traditional vs Roth differences below). Simply investing this $1,000 in her IRA immediately saves her $240! How? When Anna files her federal taxes for the current year, she gets to deduct the $1,000 invested in her traditional IRA from her taxable income. Therefore, Anna saves $240 ($1,000 x 24% tax rate) in federal taxes and would likely get an additional tax deduction from her state taxes as well. Boom shakalaka!

IRA Withdrawals

Similar to employer-sponsored retirement accounts, the two ages you need to remember for IRA withdrawals are 59 ½ and 72 (age 70 ½ if born prior to July 1, 1949). If you withdraw funds from your IRA prior to age 59 ½, you will be subject to income taxes on the amount withdrawn and a 10% penalty (except for the circumstances discussed below).

Once you turn 72 (age 70 ½ if born prior to July 1, 1949), you are required by the IRS to begin withdrawing a calculated amount from your IRA each year (except for Roth IRAs). Fail to do so and you have to pay a 50% penalty on the amount not distributed as required (the IRS is a bully). In addition, there is no exception to these required minimum distribution rules even if you are still working. For IRAs, including SEP and SIMPLE IRAs, there is no “still working” exception to the required minimum distributions: you must start withdrawals once you reach the age of 72 (excluding withdrawals from a Roth IRA).

If you read the separate posts on employer-sponsored retirement plans, you should remember there are certain exclusions to the early withdrawal penalties. If so, throw those out the window: those plans and IRAs have separate early withdrawal penalty exceptions. For IRAs specifically, the IRS will not charge you the 10% penalty on withdrawals before age 59 ½ under the following circumstances:

- Education (To pay for qualified higher education expenses)

- First-Time Homebuyers (Only up to $10,000)

- Medical expenses (To pay for unreimbursed medical expenses in excess of 10% of Adjusted Gross Income (>7.5% if age 65 or older). We cover AGI in our separate post on taxes)

- Medical insurance premiums (Only if unemployed)

- Rollovers to another qualified plan (To transfer balance to another qualified retirement plan)

- Substantially equal periodic payments (You receive substantially equal periodic payments over your life expectancy; must be separated from employer)

- Military (You are a qualified military reservist called to active duty)

- IRS Levy (IRS takes money directly from your account to pay taxes owed)

- Disability (Total and permanent disability of the participant or owner)

- Death (Of the participant or owner)

It’s important to distinguish that the IRS provides exceptions to the early withdrawal penalties for separation from service (when you retire, quit or get fired from your job during or after the year you reach age 55 [age 50 for public safety employees of certain plans] and court-ordered domestic payments (e.g., to pay spousal payments) for qualified plans (401(k), 403(b), 457 & TSP) only; therefore, you will be penalized for unqualified withdrawals from your IRA for these expenses.

Traditional vs Roth (IRA)

Before investing in an IRA, you need to decide between the two choices: traditional or Roth. Similar to the rules for employer-sponsored retirement accounts, the difference between “traditional” and “Roth” plans is primarily a difference in timing of when you pay state and federal income taxes (as well as certain rules/limitations related to withdrawals).

When you fill out your tax return each year, you start with your earned income before reducing it by certain amounts to calculate your “taxable income.” You then multiply your taxable income by the applicable tax rates to calculate your taxes owed. Thus, the more you can lower your taxable income, the smaller the amount you’ll pay the federal, state or even local government in taxes each year. If you contribute to your IRA, whether or not those funds reduce your taxable income this year or reduce your tax bill when you eventually withdraw the funds in retirement depends on whether your IRA is traditional or Roth.

At a high level, a traditional IRA is tax-deductible up front (meaning you will not pay taxes on that contribution amount in the current year), but you will eventually pay taxes on that amount and its earnings upon withdrawal. For a Roth IRA, you pay taxes up front, but you never pay taxes on those contributions or their earnings ever again (even upon withdrawal). We have an entire post on the specifics of traditional vs Roth IRAs and how to decide between the two, so you should take the time to read this post.

Setting up Your IRA

Good news: starting an IRA is very simple. You can open an IRA with almost any large financial institution, including banks, brokerage firms and mutual fund companies. With so many options, however, you will want to do your research. In particular, if you’re considering opening an IRA with a financial institution, you will want to understand their investment options, the expense ratios for those investment options, all applicable fees, minimum contribution requirements, customer service ratings, online tools, etc. For example, it would be smart to identify a financial institution offering no-load investments, which means the institution does not charge a commission fee when you get around to withdrawing your IRA funds (note that Fidelity, Vanguard, Schwab and T. Rowe Price are all very solid options).

Once you select the financial institution and determine whether a traditional or Roth IRA is the better option for you, access the financial institution’s website or reach out to the financial institution to set up and fund an account. After setting up and funding an IRA, you will need to also decide which investments to purchase with your IRA contributions (refer to next section, below). You will be able to monitor your IRA balance by logging into your account via the financial institution’s website, and you should receive quarterly statements from the institution explaining your balance and any fees/commissions on your assets. If you have questions about your IRA balance/investments or want to shift money around, access your online account or contact your IRA financial institution.

Which Investment(s) Should I Choose?

With an IRA, you shouldn’t have any trouble finding a particular investment option. IRAs typically provide you more investment choices than any other retirement plan, including 401(k)s, so you should have a seemingly endless menu of investment options. While investment options vary by financial institution, you can expect your administrator to offer you a wide range of stocks, bonds, mutual funds and ETFs in which you can invest your IRA funds.

Due to the wide range of investment choices for IRAs, these accounts usually provide you the opportunity to diversify your overall portfolio by investing in new instruments outside your 401(k) or other retirement plans. If you don’t have an employer-sponsored retirement plan in which you invest in target-date funds, these funds are a great option for your IRA. Target-date funds (also known as lifecycle funds) are mutual funds including a combination of stocks and bonds that gradually become more conservative as you reach your target-date of retirement. For instance, a 25-year-old in 2020 planning to retire at age 65 would invest his/her IRA in a 2060 target-date fund. Target-date funds generally have low expense ratios and make your investing responsibilities SIMPLE as they don’t require you to take frequent action to update your IRA portfolio.

If you already invest your employer-sponsored retirement plan in target-date funds or similar investments, you can either continue to invest in target-date funds or get a little more creative. Since an IRA is a tax-advantaged account (i.e., you pay lower taxes now with a traditional or later with a Roth), it’s smart to invest your IRA in tax-inefficient assets (if you plan to invest in tax-inefficient assets to diversify your overall portfolio). What does this mean? Certain investments typically result in higher taxes, whether from taxes on frequent trades or a higher tax rate on the specific investment income. For example, the IRS taxes most bond interest as ordinary income, at a current top rate of 37%, compared with a maximum of 20% for long-term capital gains and qualified stock dividends (excluding the current additional 3.8% net investment income tax for certain higher-income taxpayers). Other examples of tax-inefficient assets include high-yielding dividend stock funds, actively managed funds that trade frequently, and commodities (which are generally taxed at a higher “collectibles” rate). You may decide to invest in these tax-inefficient vehicles as a means of diversifying your overall portfolio. If this went way over your head, don’t worry. Just stick to low cost index funds, such as the target-date funds mentioned above.

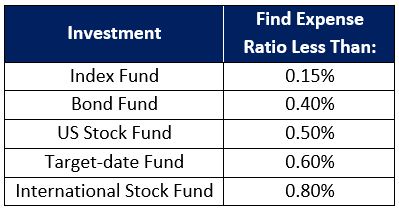

Speaking of low cost, do not forget about expense ratios!! Regardless of your investment options, you should search for investments meeting your desired portfolio with the lowest expense ratios. An expense ratio is an annual fee representing the percentage of your investment that goes toward the costs of running a fund. For example, if you invest in a mutual fund with an expense ratio of 1%, you will pay $10 for every $1,000 invested each year. Over time, these fees can significantly drag down your investment returns, so it’s very important to pay attention to these ratios.

Expense ratios vary depending on the type of investment and the cost to run the respective fund. In general, you want to select investments based on the following expense ratio criteria:

IRA or Employer-Sponsored Retirement Account?

Let’s say you’ve reached Priority 5 but only have a few thousand or even hundred dollars to save. Assuming you have already contributed the minimum percentage to your employer-sponsored plan to maximize any employer match (Priority 3), should you invest these remaining hard-earned dollars in an IRA or the same employer-sponsored retirement account? You may not like this answer, but it depends.

After you have contributed the necessary percentage to your employer-sponsored retirement account [e.g., 401(k)] to receive the maximum employer match, you’ll want to take a step back and assess (1) whether any family or friends have been super gracious and already contributed to your IRA, (2) whether your IRA or your employer-sponsored retirement account offers the better investments and lower expense ratios and (3) whether the unique perks of a Roth IRA (e.g., no required minimum distributions at any age and easy access to tap your IRA savings) could reasonably apply to you.

For the majority of people, once you have maxed out any employer match, it would be in your best interest to invest in your IRA. As discussed earlier, the Roth IRA is a terrific option, and IRAs usually provide the best investment options at the lowest cost. If you decide to go this route, you would (1) contribute just enough to your employer plan to receive the employer match, (2) contribute the maximum annual amount to your IRA allowed by the IRS, and then (3) contribute the IRS maximum (less the amount contributed in step 1) to your employer plan.

Remember, save whatever you can. Most people never get to the point of having enough savings to accomplish all this saving, so just keep with it and save what you can!

good brief intro to an IRA

Glad you enjoyed it!

helpful summary. thanks

Thanks again, Ted

I still find it challenging to contribute each year.

You’re in good company – I would say 99% of us do too. It’s all about priority and putting your savings in a place where you can get the most bang for the buck (e.g., 401(k) match then take advantage of tax-free opportunities). Any amount is a good amount

My kids will be reading this!

Hope they enjoy – thanks for passing along!

you are unpatriotic if you don contribute to an IRA

Haha that’s one way to look at it

This is helpful. For some reason I assumed I couldn’t contribute to an IRA since I have a 401k

Now you know! Thanks for reading

Really good summary

Thanks again, Paul

That’s hard to believe that fewer than 1/5 contribute to an IRA

It’s hard for me to believe too. Thanks for reading!

Another reason my children needs jobs

Haha great comment

Nice article

Thank you! You’re welcome to subscribe

Another good one!

Thanks again, Alec. Hope your class enjoys it!

like

Thank you!