If you’re looking for simple ways to save money on taxes, you’ve come to the right place. These strategies won’t make you Jeff Bezos-rich, but these actions could easily save you enough to splurge in whatever way your heart desires. Let’s get to it.

In our first post on taxes, we discuss the differences between tax evasion and tax avoidance. Whereas tax evasion is illegal and can put you behind bars, tax avoidance is perfectly legal and should be your goal. It’s your responsibility (and should be your priority) to minimize your taxes using rules and methods approved by the IRS.

Each year you can consider your tax return your tax “report card” for the previous calendar year: the amount of your refund or tax bill depends on the actions you took during that respective tax year. Believe it or not, there are some easy ways to legally finagle your spending or saving behavior to save hundreds or thousands on taxes. Here are ten tax strategies you should remember:

- Push income to year of lower tax rate: If you expect your tax rate to change from one calendar year to the next, consider delaying or accelerating any income you expect to receive near year-end. Typically, it makes sense to defer income to delay paying tax or if you expect a tax cut in the subsequent year. For example, if you expect your tax rate to drop next year due to a new tax law, ask your boss if you can delay the payment of your year-end bonus to January 1st. Alternatively, if you expect your tax rate to increase next year (e.g., due to a rise in income), accelerating income can save you money as well.

- Push deductions to year you itemize and/or year of higher tax rate: Similar to the concept of shifting income, you want to manage your year-end expenses as well. First, you want to make sure your deductions are actually deductible. This gets back to the concept we cover in the post on taxes for beginners: not everything that is “tax deductible” is in fact deductible. Most deductions are only deductible if you itemize, so it’s important to push deductions to the year you itemize if you switch between the standard deduction and itemized deductions in two consecutive years.

For example, say you expect to move from Florida (which has no state income tax) to New York City (with high state and local income tax) next year. Also say that you expect this new increase in state & local income tax to push your itemized deductions (refer to post on taxes for beginners) above the standard deduction amount next year (i.e., you expect to take the standard deduction this year and itemize next year). If you had planned to make a charitable contribution before year-end of this year, you should delay that donation until January 1st to receive the tax deduction on that charitable donation.

If you are going to itemize in both consecutive years, or if you have certain above-the-line deductions that are applicable in two consecutive years, push these expenses to the year in which you expect to have a higher tax rate. Doing so increases the tax value of your expenses by decreasing your income subject to tax in the year of your higher tax rate. For example, if you plan to itemize this year and the next but expect your tax rate to drop next year, you could prepay the next installment of your property taxes before year-end to drop your taxable income in the current, higher tax-rate year. One caveat to this strategy: if you’re close to triggering the AMT (refer to post on taxes for beginners), beware of accelerating deductions as this can push you past the AMT threshold.

- Avoid short-term investing: It’s in your best interest to maintain a buy-and-hold investment strategy. As we will cover in another post on investing, there’s no need to actively trade unless you’re an investment professional or willing to spend several hours a day/week researching investment trends and analyzing financial statements. Not only does this strategy typically not beat benchmark indices, but you end up paying more in taxes from the bevy of short-term capital gains. The IRS rewards you for hanging onto your investments for at least a year, so take advantage.

- Sell loser investments in year of higher tax rate: When you have capital losses, the IRS allows you to use them to offset capital gains on your tax return. Furthermore, if your capital losses exceed your capital gains, you can deduct your excess capital losses from ordinary income up to $3,000 per year. Any additional losses in excess of that $3,000 ordinary income limit can be carried forward to offset capital gains and ordinary income in future years (note the limit is $1,500 if you file married filing separately).

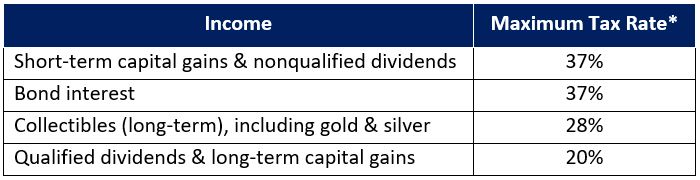

With this in mind, it’s best to take advantage of these losses in years you expect to have a higher tax rate. For instance, if you have some investments in a loss position which you plan to sell, think about whether your tax rate will be higher this year or next year. If you expect a drop in income or tax laws to lower tax rates next year, go ahead and sell those investments now to offset income this year, when you expect your tax rate to be higher. - Shelter highly-taxed investments: The IRS taxes certain income at different rates. For instance, here are maximum tax rates for common types of investment income:

*Does not include additional 3.8% tax on net investment income for high-income taxpayers (included as part of the Affordable Care Act)

*Does not include additional 3.8% tax on net investment income for high-income taxpayers (included as part of the Affordable Care Act)

Recognizing these differences, you should strive to invest any highly taxed investments in your tax-advantaged accounts. For instance, if your investment portfolio includes bonds, actively managed funds (as they tend to trade frequently and rack up short-term capital gains) or collectibles (including gold and silver funds that own the physical metal), it’s best to invest these in your 401(k) or IRA. You can then use your taxable (i.e., non-retirement) accounts to invest in buy-and-hold equity funds (e.g., mutual funds and index funds) and other investments with low tax rates, such as municipal bonds (their interest income is tax-free). This strategy will allow you to pocket more of that hard-earned investment income.

- Remain aware of available tax credits: The IRS frequently changes the variety of and qualifications for tax credits, so make sure you remain up-to-date on tax credit offerings. This shouldn’t just be an afterthought when filling out your tax return; make sure you’re aware of available tax credits early in the current year. These credits should play a part in your spending lifestyle during the entire calendar year to reap the rewards when filing your return the following year.

- Take advantage of tax-advantaged accounts: I’m not sure I could’ve made this clearer in the post on retirement account basics, but here’s another reminder: use your tax-advantaged retirement accounts! This includes your IRA and any available employer-sponsored retirement account (e.g., 401(k), 403(b), 457, TSP and so on). I can’t overemphasize the savings provided by these accounts.

You should also take advantage of pre-tax accounts offered by your employer, such as health savings accounts, pre-tax child-care reimbursement accounts and pre-tax commuter programs. These accounts effectively allow you to avoid income tax if the funds are spent on eligible costs covered by the plan. In other words, if you expect to spend any money on medical or dental services, child care or public transportation, these programs can provide significant tax savings.

- Update your tax withholdings and estimated tax payments: Research by the IRS has shown that typically more than 70% of Americans receive refunds, each averaging close to $3,000. That’s a lot of cash, and way too much in my opinion. As discussed in the post on taxes for beginners, tax refunds aren’t a reason to celebrate. Your goal should be to break even every April 15th, or at least have a relatively small tax bill. Receive a refund and you gave the government a free loan. Receive too high of a tax bill and you may owe the government interest or penalties.

Each year when you file your tax return for the previous calendar year, reassess your tax withholdings and estimated tax payments for the current calendar year. If you received a large refund, request to update your W-4 with your employer to decrease your tax withholdings (or reduce your estimated tax payments, if applicable). Use the opposite strategy if your tax bill was high.

- File early for your refund: If you’re confident you are going to receive a refund, file EARLY. As in February. There are a lot of heartless people out there jumping to steal your refund. They somehow snag your name and SSN, and then they file your tax return. The longer you wait, the longer you expose yourself to these thieves. In addition, the longer you wait, the longer you miss out on the rate of return you can receive from investing that cash earlier. Time value of money, right? Full circle.

- Maintain your integrity: You will undoubtedly have an opportunity to lie on your tax return, but don’t compromise your integrity. Sure you may save a few bucks that the IRS will never catch, but it’s not worth it. As Oprah said, “real integrity is doing the right thing, knowing that nobody’s going to know whether you did it or not.” Do the right thing and move forward without any guilt.

Well written, Adam

Thanks again, Caitlin

It is not easy to predict whether your tax rate will increase or decrease next year, so some of these strategies are easier said than done.

I agree – it can be challenging. To the extent it’s easier to predict (e.g., new tax law, significant increase or drop in income), that’s when these strategies really pay off

moving deductions is far less useful with this new tax law

Thanks for the comment, Shawn. True, but it’s still useful for those who itemize

show me anyone who would actually delay income

Thanks for the comment, Jeannette. If it saves me money, I’d be willing!

Out of those 10 strategies, tax-advantaged accounts likely save you the most.

Thanks, Paul – I can’t disagree with that

I like the simplicity and examples.

Thanks again, Tiffani

For a random blog, these posts are very good.

Ha I’ll take it. Thanks for reading, Maggie – I’m glad you like it

I would now add moving to a low-tax state to this list

As a New Yorker, I cannot disagree with that

I like so much